Infrastructure & Growth

The budget demonstrated a strong emphasis on infrastructure development, which is expected to fuel commercial vehicle demand. It featured a Viksit Bharat

focus, indicating a vision for a developed India. The cement industry and the overall infrastructure sector were earmarked for significant boosts, suggesting an intent to accelerate economic expansion. The budget's initiatives were broadly welcomed by business leaders, who acknowledged its growth-oriented nature. The Union Budget was seen as providing a roadmap for growth and supporting MSMEs by the IOB. The government also proposed home loan interest deduction as a part of the budget.

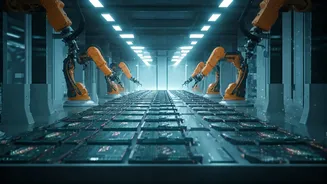

Manufacturing Boosts

A significant thrust was given to manufacturing, with the goal of boosting this vital sector. The budget included incentives and policies designed to foster manufacturing growth. The focus included promoting rare earth corridors and initiatives tailored to support the manufacturing sector. Textile stocks surged after the budget announcements, pointing towards a positive outlook for the industry. The budget's announcements were seen as contributing to the overall advancement of the manufacturing landscape in India. These measures were intended to establish India as a global manufacturing hub, promoting domestic production and creating employment opportunities.

Skill Development Investments

The Skill Ministry saw a substantial increase in its budget, with allocations reaching ₹9,886 crore. This signifies a commitment to enhancing the skill set of the nation's workforce. The investments in skill development are essential for creating a talent pool that will drive industrial growth. This focus on skill development is meant to prepare a proficient workforce to seize chances and contribute to the growth of various industries. The investments reflect the government's recognition of the critical importance of a skilled workforce in achieving economic objectives.

Healthcare & Wellness

The budget prioritized healthcare, with a specific focus on mental health and cancer drug development. The commitment to healthcare extended to the AYUSH and nutraceutical ecosystem, indicating a focus on comprehensive well-being. Increased allocations for pollution control demonstrate a dedication to environmental sustainability and public health. This focus aims to provide better healthcare access and solutions for the population. These healthcare-related initiatives mirror a commitment to holistic wellness and a healthy society, aligning with the broader developmental objectives of the budget.

Taxation and Finance

The budget included proposals to rationalize employer contributions for PF trusts. It introduced several IT tax overhauls intended to reduce litigation and enhance India's appeal as a hub. The budget extended an exemption for N-plant imports to 2035. The budget featured no deduction on dividends and MF interest. The goal was to streamline tax regulations and boost economic activities. The changes would impact financial planning for both businesses and individuals.

Sector-Specific Reactions

Diverse sectors responded to the Union Budget 2026-27. The Amul group welcomed the budget, anticipating boosts for dairy and cooperatives. The logistics industry reacted, acknowledging potential advantages. Telangana Inc welcomed the Union Budget. ICAI on the other hand, focused on the stable regulatory environment. The budget was received with varied expectations across the economic landscape. These diverse views showcase the complex impact of the budget and its varied relevance across different sectors.