Budget's Broad Themes

The 2026-27 Union Budget is centered on several key themes, notably fostering economic growth and creating employment opportunities. This overarching focus

is evident in strategic allocations across various sectors. The budget anticipates a strong fiscal year, with the Finance Minister emphasizing a commitment to sustaining a growth rate of 7-8%. This optimistic outlook is supported by reforms designed to boost investment and streamline processes. The budget's structure is also geared towards building a robust and resilient economic environment. The core principles underscore the government’s dedication to a stable and prosperous future for India.

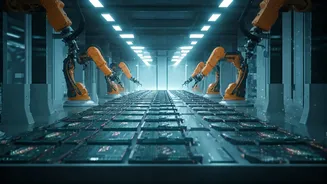

Manufacturing Gets Boost

A significant thrust of the budget is the push towards strengthening the manufacturing sector. This is reflected in various policy decisions and financial allocations. The aim is to catalyze industrial output, create jobs, and enhance India's global competitiveness. The budget incorporates measures designed to improve ease of doing business for manufacturers. The government aims to foster an ecosystem conducive to investment and innovation. The emphasis on manufacturing is seen as a pivotal step towards achieving long-term economic prosperity and self-reliance, with the expectation that this will generate employment across various sectors. This boost is a central tenet of the overall economic strategy.

Infrastructure Development Focus

The budget underscores the government's commitment to infrastructure development, a crucial driver of economic growth. Substantial investments are directed towards improving and expanding infrastructure projects across the country. This includes investments in transportation, logistics, and urban development. Such initiatives are aimed at enhancing connectivity, improving efficiency, and stimulating economic activities in various sectors. The budget’s emphasis on infrastructure demonstrates a forward-looking approach, ensuring that India has the necessary foundations for sustained economic expansion. The aim is to create modern and efficient infrastructure systems. The initiatives are projected to boost demand in related industries.

Support for MSMEs

Recognizing the vital role of Micro, Small, and Medium Enterprises (MSMEs) in the Indian economy, the budget includes provisions to support their growth. MSMEs are crucial for job creation and contribute significantly to economic output. The budget includes measures to improve access to finance, enhance market access, and reduce the compliance burden for MSMEs. By providing this support, the government intends to help MSMEs thrive, leading to employment growth and innovation. The focus is to make MSMEs more competitive, enabling them to contribute more effectively to India’s economic growth story. The budget's focus is on streamlining operations.

Tax Reforms Unveiled

The Union Budget 2026-27 also includes significant tax reforms, designed to streamline processes, reduce litigation, and boost investment. These reforms aim to create a more transparent and efficient tax regime. A key objective of these reforms is to reduce the burden of compliance for taxpayers, making the tax system easier to navigate. The reforms reflect a broader effort to improve the overall investment climate in India. These measures are seen as steps towards creating a more investor-friendly environment. These tax changes are expected to contribute to economic stability.

Impact on Sectors

The budget's provisions are expected to have a diverse impact on various sectors of the Indian economy. The manufacturing sector is poised to benefit from increased investment and supportive policies, as is the cement industry. The infrastructure sector will likely see increased activity due to government spending and focus. Furthermore, MSMEs are likely to experience improvements in their operational environment. The budget is anticipated to boost sectors like dairy, cooperatives, and textiles, indicating a broad-based economic strategy. These impacts illustrate the budget’s wide-ranging influence. Specific allocations are tailored to support targeted industries.

Key Economic Indicators

Several economic indicators are central to the fiscal strategy outlined in the 2026-27 Union Budget. The government expects to achieve and maintain a growth rate of 7-8%, a target underpinned by various policy decisions and investments. The budget also anticipates a significant contribution from the Reserve Bank of India (RBI), expecting a dividend of ₹3.16 lakh crore. Fiscal targets and debt management strategies also remain critical to ensuring long-term financial stability. These figures highlight the fiscal prudence and planning. These indicators serve as benchmarks.

Reactions and Analyses

The 2026-27 Union Budget has drawn varied reactions from industry leaders, economic analysts, and political observers. Many industry bodies, like the Sikkim Chamber and Telangana Inc, have welcomed the budget, highlighting its growth-oriented approach. Some have expressed concerns and offered critical analyses. The discussions on the budget’s impact have underscored the complexity and far-reaching implications of the economic proposals. These diverse reactions reflect the differing perspectives and priorities of various stakeholders. These analyses will help shape the government’s approach.