Redemption Peaks Emerge

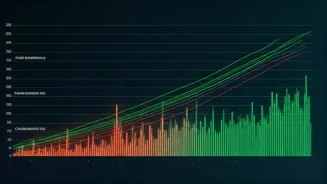

Recent financial activities indicated a rise in redemptions from funds focused on India. These redemptions reached levels not observed for two months,

suggesting a shift in investor sentiment. The outflow of funds is a significant indicator within the financial market as it reflects how investors are viewing the Indian market. This could be due to a variety of factors, including global economic conditions, changes in domestic policies, or adjustments in portfolio strategies. These redemptions are important because they are an indicator of the overall health and perceived risk of the market. Understanding this trend is critical for investors and policymakers to make informed decisions.

China's Investment Steadfast

Simultaneously, the situation sees a continued inflow of investment from China. Despite redemptions, the commitment from China remains strong, showcasing a contrasting pattern within the broader investment picture. This steady flow is a vote of confidence in India's long-term economic prospects. China's continued interest might stem from strategic partnerships or a belief in India's potential for high growth. The sustained investment underlines the complexities within international finance. This creates a fascinating dynamic where the Indian market is dealing with outflow of funds and at the same time is receiving constant investments from China.

Commodity Trade Resilience

Furthermore, the movement of commodities continues to remain resilient. Trade in commodities, a key segment of the economic activity, demonstrates stability. This signifies the presence of strong fundamental economic drivers. The robustness in the commodity sector is a reassuring factor, as it supports other industries that rely on raw materials. This highlights the broad strength of various economic sectors that support the overall economy. This continuous flow of trade suggests healthy commercial activity within India, providing a balance to the shifts happening within the financial markets.

Understanding Market Dynamics

The interaction of these trends paints a complex picture of the Indian market. The increase in redemptions could be fueled by various factors, requiring detailed investigation. These include the shifting of investor risk appetites or adjustments in global economic forecasts. The strength demonstrated by Chinese investment and the commodity trade presents a counterbalance. Evaluating these different streams provides a holistic understanding of the market's trajectory. Market analysts and stakeholders must continuously assess such dynamics, to make well-informed decisions and prepare for possible shifts.