Budget Overview

The Union Budget 2026-27 is designed to stimulate economic growth across numerous sectors of the Indian economy. Several significant allocations and policy

decisions were outlined within the budget. These included substantial investments in key areas and strategic initiatives that would influence the economic landscape. The budget underscored a focus on manufacturing, with specific attention directed towards boosting the sector's competitiveness and capacity for growth. In addition, the budget aimed at improving infrastructure development, with plans for increased spending in crucial areas such as transportation and logistics. Alongside these initiatives, the budget proposed measures to promote financial inclusion and rural development. The government is also putting increased focus on technology and innovation, with plans to support the digital economy and emerging technologies. This holistic strategy aims to foster sustainable and inclusive growth across various aspects of the Indian economy.

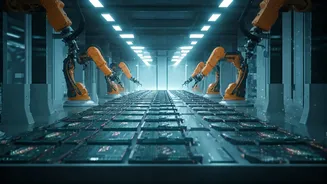

Manufacturing Boost

A significant focus of the Union Budget 2026-27 was the drive to invigorate the manufacturing sector. The budget included various incentives and policy measures tailored to support manufacturing industries. These initiatives aimed to increase production, improve competitiveness, and generate employment opportunities within the sector. Key measures included tax benefits, investment-friendly policies, and streamlined regulatory processes. The government also proposed initiatives to strengthen infrastructure crucial for manufacturing. These included improvements to roads, ports, and other transportation facilities to ensure smooth supply chains and reduce logistical costs. The budget also focused on encouraging innovation and technological upgrades within manufacturing. It provided funding and support for research and development activities, helping manufacturers adopt advanced technologies and improve production processes. By addressing both financial and infrastructural aspects, the budget seeks to create a favourable environment for the manufacturing sector to expand, contribute significantly to economic growth, and create more jobs.

Infrastructure Push

The Union Budget 2026-27 included substantial investments to accelerate infrastructure development across India. The budget allocated significant financial resources to several infrastructure projects. These resources are slated to improve transport networks and logistical efficiency. A primary focus was on enhancing the country's roadways, including both national highways and rural roads. Additional projects focus on improving and expanding the railway network, thus promoting better connectivity. Investments also supported the development of modern ports and airports, helping to improve international trade and domestic commerce. The budget's infrastructure initiatives had the objective of bolstering India's economic competitiveness and providing better connectivity. The government hopes to generate employment opportunities and improve the overall quality of life for citizens. By prioritizing infrastructure, the budget aims to lay a solid foundation for sustained economic growth and development in the long run. Emphasis was also placed on sustainable and eco-friendly infrastructure projects to ensure environmental sustainability.

Technological Advancements

The Union Budget 2026-27 demonstrated a strong commitment to promoting technological advancements and innovation across several sectors. The budget proposed initiatives to support the digital economy and the adoption of cutting-edge technologies. These initiatives aimed to foster the growth of digital infrastructure, improve digital literacy, and boost the adoption of digital services. A significant part of the budget was dedicated to research and development. The government planned to provide funds and resources to academic institutions and research organizations. This aimed to foster innovation and help India become a global leader in emerging technologies. Moreover, the budget included measures to promote the development of a skilled workforce capable of meeting the demands of a tech-driven economy. This involved vocational training programs and educational initiatives designed to improve digital literacy and upskilling opportunities. The emphasis on technology reflects the government's understanding of its pivotal role in driving economic growth, creating employment, and improving overall living standards.

Rural Growth Initiatives

The Union Budget 2026-27 included provisions to support rural development and boost agricultural productivity. Several schemes and programs were allocated funds with the specific aim of improving rural infrastructure, promoting agricultural practices, and improving the quality of life in rural areas. The budget focused on strengthening infrastructure, including irrigation facilities, storage facilities, and rural road networks. Moreover, the budget supported various agricultural initiatives. These initiatives included subsidies for farmers, enhanced access to credit, and programs to promote sustainable farming practices. The government also sought to improve social welfare in rural areas. This included initiatives for healthcare, education, and sanitation. The government planned to create employment and improve incomes in rural areas by focusing on rural development. This would also enhance the overall well-being of the rural population.

MSME Support

The Union Budget 2026-27 extended several measures specifically designed to support the growth and development of Micro, Small, and Medium Enterprises (MSMEs). These enterprises play a crucial role in India's economy, contributing significantly to employment generation and economic growth. The budget included specific provisions to improve the MSME sector's access to finance. This aimed to simplify loan processes and provide easier access to credit facilities, enabling these enterprises to secure funds for expansion and operations. The budget also focused on streamlining regulatory processes for MSMEs. This included measures to reduce compliance burdens and simplify bureaucratic procedures, making it easier for them to operate and thrive. Additionally, the budget encouraged the adoption of technological advancements among MSMEs. The government proposed financial assistance and training programs to help them incorporate digital technologies into their business processes. The concerted effort to support MSMEs reflected the budget's broader commitment to fostering entrepreneurship and driving inclusive economic growth across India.

Healthcare and Education

The Union Budget 2026-27 placed considerable emphasis on strengthening the healthcare and education sectors. It included measures to improve the accessibility and quality of healthcare services. The budget allocated funds to boost healthcare infrastructure, including hospitals, clinics, and medical facilities. This was intended to improve patient care and support public health. The budget also featured provisions to bolster the education sector, and improve the quality of education and increase access to educational opportunities. Initiatives included investments in educational infrastructure, support for teacher training programs, and promotion of digital learning resources. The budget focused on both primary and higher education, aiming to improve literacy rates and promote skills development. By allocating resources to these key areas, the budget aims to create a healthier, more educated workforce. The plan aims at creating a stronger foundation for India's long-term socio-economic development.

Fiscal Targets and Regulation

The Union Budget 2026-27 underscored the government's commitment to maintaining fiscal discipline and establishing a stable regulatory environment. The budget outlined specific fiscal targets and strategies to achieve them. These included goals for managing government spending, controlling fiscal deficits, and ensuring sustainable public finances. The budget aimed at promoting transparency and accountability in financial management. It included measures to improve budget processes, enhance financial reporting, and strengthen oversight mechanisms. A key component of the budget was the focus on providing a stable regulatory environment. The government introduced measures to simplify regulations, reduce bureaucratic hurdles, and promote ease of doing business. The budget also addressed issues such as tax reforms, with the aim of simplifying the tax system, enhancing compliance, and broadening the tax base. The government's emphasis on fiscal prudence and regulatory stability demonstrated its commitment to creating a favourable environment for investment, economic growth, and sustainable development.

Sector-Specific Allocations

The Union Budget 2026-27 incorporated focused allocations across various sectors to drive specific advancements and address sector-specific challenges. This targeted approach allowed the government to tailor its support based on the unique needs and growth potential of each industry. For the healthcare sector, the budget allocated funds for research into diseases like cancer. The budget also outlined initiatives to improve infrastructure and technological advancements for the education sector. Specific allocations were designated to the AYUSH and nutraceutical ecosystems to promote holistic health and wellness. For the agricultural sector, the budget contained measures to boost MSMEs and rural growth. The budget aimed at supporting the development of a strong and sustainable ecosystem across these key sectors, which will contribute to a more inclusive and robust economic future. These targeted financial investments also included boosts for areas like forensic schemes and skill development programs to strengthen national capabilities.

Economic Impact

The Union Budget 2026-27 has several implications for the Indian economy. The budget's focus on manufacturing and infrastructure development is expected to drive economic growth and job creation. Investments in these sectors are anticipated to boost production, improve connectivity, and enhance overall productivity. The budget's support for technology and innovation is expected to foster digital transformation. This will improve India's position in the global economy. By focusing on MSMEs and rural development, the budget aims to promote inclusive growth and reduce income disparities. The budget's emphasis on fiscal responsibility and a stable regulatory environment is intended to attract investment and build investor confidence. Overall, the Union Budget 2026-27 is a carefully designed plan to promote sustained and inclusive economic development across India. The successful implementation of these plans could lead to significant long-term benefits for the economy and the well-being of the Indian population.