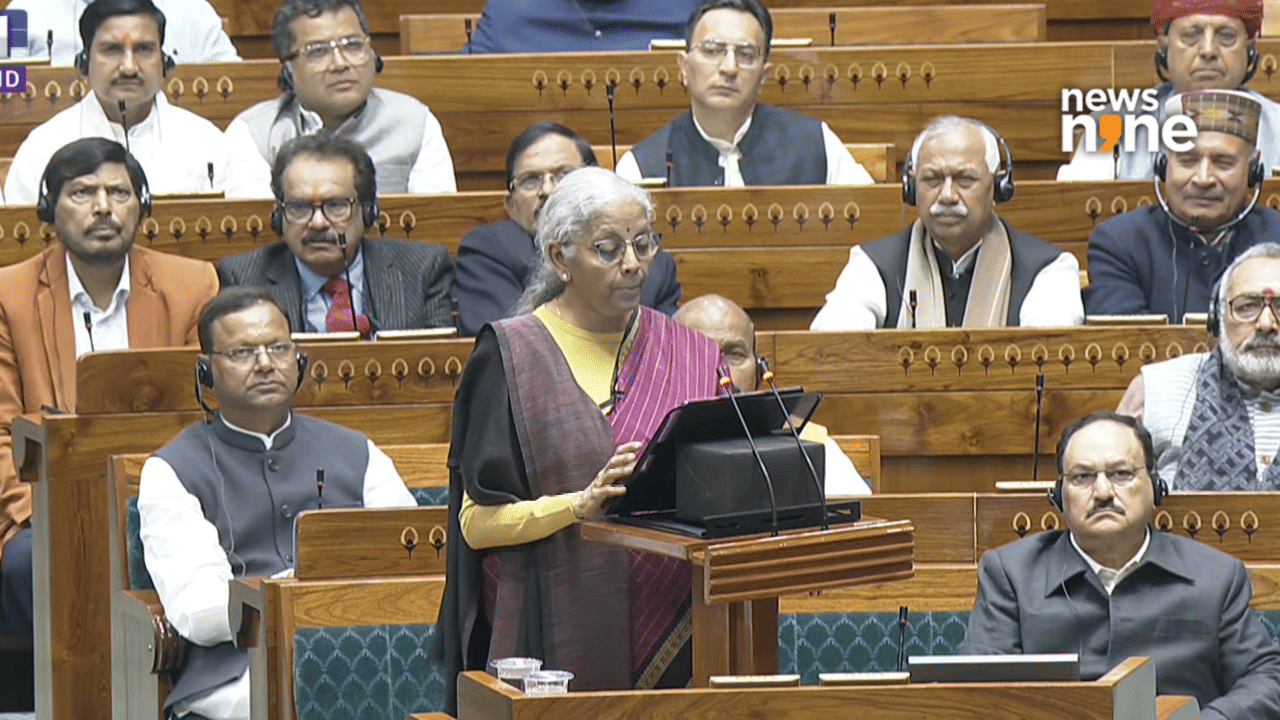

Tech Infrastructure Boost

One of the most noteworthy announcements within the budget was the government’s plan to incentivize the establishment of data centers in India. This incentive

takes the form of conditional tax-free rides for cloud giants. This strategic initiative is designed to bolster digital infrastructure, providing the necessary resources for India's burgeoning digital economy. Such a move is expected to drive innovation and increase the efficiency of data management. The emphasis on data infrastructure underscores the government's commitment to supporting the tech sector and creating an environment conducive to technological advancement. This focus on infrastructure is critical for the long-term sustainability and growth of digital initiatives across various sectors.

AI, Chips and Cloud

The budget also spotlighted a comprehensive set of measures targeted at artificial intelligence (AI), semiconductors, cloud technologies, and data infrastructure. These include direct tax initiatives aimed at encouraging investments in the tech sector, specifically focusing on TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and various income tax exemptions. These tax measures are designed to provide financial relief and stimulate investment within these crucial technology domains. By easing the tax burden, the government hopes to create an attractive environment for both domestic and international tech companies to invest and expand their operations within India. The ultimate goal is to foster a vibrant and globally competitive technology ecosystem.

Direct Tax Measures

The Finance Minister unveiled a series of direct tax measures, including changes to the rates and exemptions, to stimulate the technology sector. The proposed changes to TDS and TCS will influence how taxes are collected and deducted on transactions, thereby affecting cash flow and compliance for businesses. Income tax exemptions were also a focal point, aimed at offering tax relief to individuals and companies in specific sectors to boost investment. Furthermore, the budget included revised dates for filing returns, which streamlined the compliance process for taxpayers. These direct tax measures aimed to create a more supportive and streamlined tax environment for the tech industry, further solidifying the nation's commitment to the sector.