AI Tool Sparks Concern

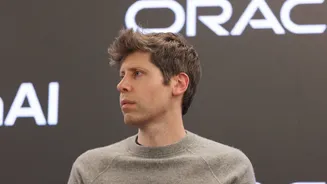

The business landscape experienced a notable shift following the unveiling of a sophisticated AI-powered productivity solution tailored for in-house legal

departments. Developed by Anthropic, this tool, initially showcased on its GitHub repository, aims to streamline operations for legal teams. Its introduction on Tuesday triggered immediate reactions in the stock market, with several prominent information and analytics companies witnessing a downturn in their share values. This swift decline underscores the market's sensitivity to technological advancements that could potentially disrupt established business models within the professional information services sector. The tool's integration with specific applications, like the agentic desktop application Cowork and Claude Code, signifies a targeted approach to enhancing efficiency in a critical business function.

Market Reacts Sharply

The market's apprehension was palpable as shares of several key industry players experienced significant dips. Information giants such as Relx, Pearson, and Informa were among the prominent decliners, with Relx seeing an 11% drop, Pearson falling by 4%, and Informa by 3.8%. Other affected entities included credit-checking firm Experian, Dutch professional information provider Wolters Kluwer, which tumbled 8.8%, London Stock Exchange Group (LSEG), down 7.3%, and Thomson Reuters, which experienced an 8.3% decrease in pre-market trading. This widespread impact suggests a broader industry concern about the potential for AI to automate tasks traditionally handled by these companies, potentially affecting their revenue streams and market positioning. The collective stock performance paints a clear picture of the immediate economic anxieties stirred by Anthropic's AI innovation.

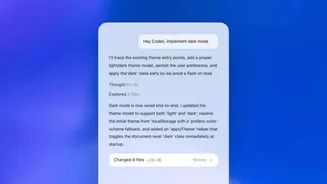

Tool's Capabilities Detailed

Anthropic's newly launched AI tool is designed as a productivity plugin, specifically engineered to automate a range of tasks for in-house legal professionals. Its functionalities, detailed on its GitHub page, include the capability to review contracts, efficiently triage Non-Disclosure Agreements (NDAs), navigate complex compliance requirements, assess potential risks, prepare for meetings, and draft standardized responses. Crucially, these capabilities are adaptable, allowing organizations to configure the tool according to their unique operational playbooks and risk tolerance levels. This high degree of customization suggests a powerful utility that can integrate seamlessly into existing legal workflows, potentially leading to substantial gains in efficiency and accuracy for companies that adopt it.

Data Value vs. Platform Power

Analysts suggest that while AI presents challenges, it also offers opportunities, particularly in the realm of data. Experts at Third Bridge indicated that proprietary data remains a difficult asset to replicate solely through AI, suggesting that companies like LSEG, which focus on providing unique data, are well-positioned. The implementation of protocols like Model Context Protocol (MCP) can act as a protective measure for valuable data and a catalyst for growth. The sentiment is that pricing power might shift from the platforms themselves towards the underlying data. LSEG, for instance, is strategically positioning itself as a data provider, enabling third-party AI tools, including those from Anthropic, to function as 'answer engines.' This approach allows for monetization irrespective of the interface used, as many of these data sources are not publicly accessible.