IPO Price Band

The Gujarat Kidney and Super Speciality IPO has established a price band between Rs 108 and Rs 114 per share. This range provides potential investors with

a financial framework for participation in the IPO. The final pricing decision will be influenced by investor interest and market conditions. Understanding the price band is an initial, vital step in evaluating the IPO, enabling investors to gauge the potential cost of acquiring shares. This price range helps determine the overall valuation of the company during its IPO launch. Examining the price band alongside other IPO details, such as the company's financial performance and future growth prospects, is essential to making an informed investment decision.

GMP: Early Signals

The Grey Market Premium (GMP) offers a preliminary indication of investor interest in the Gujarat Kidney and Super Speciality IPO. Although unofficial, the GMP reflects the premium at which shares are traded in the grey market before the official listing. Monitoring GMP trends can offer insights into the expected listing price and investor sentiment. A higher GMP suggests strong demand, while a lower or negative GMP may indicate a less enthusiastic response. Investors can use the GMP as one data point among others to evaluate the potential of the IPO. It is crucial to remember that the GMP is not a guaranteed indicator of the IPO's success, as it is based on speculation and subject to change before the listing day. Therefore, it's wise to consider GMP in conjunction with other financial metrics and expert analysis.

About the Company

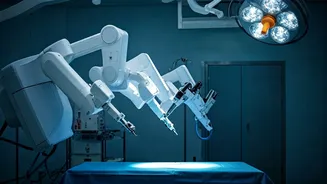

The Gujarat Kidney and Super Speciality IPO involves a company focused on specialized healthcare services. Understanding the business model, the services offered, and the company's market positioning is crucial. Evaluating the company's financial performance, including revenue, profitability, and debt levels, is also important. Analyzing its competitive landscape and growth prospects helps assess its potential for long-term success. Investors are advised to examine the company's management team and corporate governance practices. Understanding the company's future growth strategy, including expansion plans and market strategies, can also provide valuable insights into its investment potential. A detailed examination of these aspects will help investors in assessing the overall attractiveness of the Gujarat Kidney and Super Speciality IPO and making informed investment choices.

Lead Managers' Role

Lead managers play a critical role in the IPO process. They are responsible for structuring the IPO, conducting due diligence, preparing the offer documents, and marketing the IPO to potential investors. The lead managers' reputation and expertise can impact the IPO's success and investor confidence. They advise the company on pricing, the timing of the IPO, and compliance with regulatory requirements. The lead managers typically conduct roadshows to generate interest from institutional investors. Their extensive network and experience in the capital markets help secure the necessary funding and increase the chances of a successful IPO. Investors should consider the track record and reputation of the lead managers, as they significantly influence the IPO's outcome and the company's future prospects. Choosing experienced and reputable lead managers provides confidence in the IPO's management and financial strategies.