Hiring Trends Surge

According to a recent report, the hiring rate in India saw a rise of 15% in December. This positive trend points towards an expanding job market, which

is generally a sign of economic health. The increase could be credited to a number of factors, including the expansion of certain sectors and a general sense of optimism within the business community. This data illustrates a recovery from previous economic slowdowns, suggesting that companies are now confident enough to increase their workforce. While this uptick in hiring is encouraging, it is essential to consider the broader economic context to comprehend its full implications.

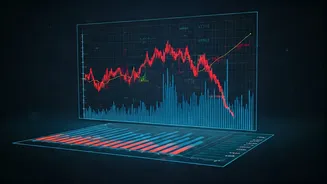

Market Downslide Observed

Despite the increase in hiring, the stock markets concluded the trading period on a negative note. This decline may be attributed to a multitude of elements, like the actions of foreign investors and global economic uncertainties. Outflows of funds from foreign entities have a direct impact on market performance, leading to a decrease in overall index values. Investors may be responding to economic indicators and global challenges, resulting in increased caution and market volatility. Examining both the domestic and worldwide economic environments offers a comprehensive understanding of these market shifts. The fall in markets could reflect cautious investor behavior in reaction to changing financial circumstances.

Financial Sector Insights

Within the financial sector, there were several major developments. ICICI Lombard reported a 9% decrease in profits during the third quarter, settling at Rs 659 crore. Conversely, ICICI Prudential saw a 19% increase, with profits reaching Rs 390 crore in the same period. Bank of Maharashtra also showcased positive results, with a 27% increase in Q3 profit, accompanied by the declaration of dividends. These reports underscore the diverse performance of various financial institutions and indicate the varying degrees of resilience and profitability within the sector. Additionally, the RBI's decision to resume licensing for Urban Co-op Banks highlights regulatory adjustments and evolving financial strategies.

Trade & Investment News

Several notable investment and trade developments also took place. Mutual Fund SIP inflows surged to Rs 3.34 lakh crore in 2025, showing sustained investor interest. Furthermore, CloudSEK secured $10 million from Connecticut Innovations, and ChrysCapital received CCI's approval to acquire a stake in Nash Industries. Uday Kotak Family Office made a move by acquiring the Go Raw snack brand, demonstrating continued confidence in the consumer market. These investments showcase diverse strategic moves across multiple sectors, highlighting the dynamism of the Indian economy and investor confidence in its growth potential.

Sector-Specific Updates

In specific sectors, there were significant announcements. Tata Motors anticipates double-digit sales growth in 2026, boosted by its SUV segment. Samsung is optimistic about its India outlook for 2026, with a focus on AI initiatives. Kisna Diamond is planning to hire 1200 people in FY26, highlighting growth in the diamond industry. The government’s focus on the MSME sector, which is deemed critical to India's development by 2047, further stresses the importance of diverse sectors within the national economy. These occurrences reflect the strategic plans of major firms and indicate the potential for progress and expansion across various industries.

Regulatory & Policy Updates

Regulatory and policy modifications are shaping the Indian business landscape. The RBI is preparing to resume licensing Urban Co-op Banks, and MOSPI has proposed a chain-based compilation of the IIP. The PFRDA panel is working on assured NPS payouts, suggesting government focus on improving financial security. Additionally, the Maharashtra government and ICC signed a MoU to boost the industry, which aims to drive economic activity. UPI is projected to double to 1 billion users, indicating greater digital payments adoption, while the government is advocating for financial inclusion in the country. These actions underline the government's aim to support economic growth and improve financial inclusion.