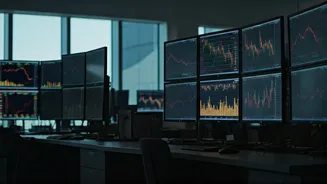

Market Analysis Today

Today's stock market analysis provides a crucial understanding of current market conditions, including factors influencing stock movements. Analyzing market trends,

expert recommendations, and specific stock performance are essential for making informed investment decisions. This section offers a comprehensive overview of the market, which can assist investors in evaluating their strategies and making suitable choices.

Buy/Sell Recommendations

Experts often suggest specific stocks for buying or selling, based on detailed assessments of company performance, market trends, and growth potential. This involves careful consideration of factors such as financial health, industry outlook, and overall market sentiment. Such recommendations are meant to guide investors in identifying potentially profitable opportunities. Investors can review expert picks to make decisions aligned with their financial objectives.

Grasim Industries Analysis

Grasim Industries is one of the stocks often recommended. An analysis would focus on factors such as its recent financial performance, market position, and growth strategies. Investors may consider its potential for capital appreciation. Key areas for assessment include recent financial reports, analyst ratings, and comparative analyses with its sector peers. A close look can help assess the potential growth and investment viability of the stock.

Aurobindo Pharma Overview

Aurobindo Pharma, another recommended stock, merits examination of its product pipeline, market expansion efforts, and competitive landscape. The company's performance, along with its strategic initiatives, are critical. Assessing the company's strengths, weaknesses, opportunities, and threats (SWOT) is beneficial. The stock's performance is affected by factors like regulatory approvals, market penetration, and industry trends.

Religare Broking Insights

Ajit Mishra of Religare Broking offers valuable insights, which are crucial for informed decision-making. These insights might include discussions on market dynamics, sector performance, and predictions on upcoming trends. Understanding these perspectives can provide investors with a broader outlook on market conditions and the potential impact on their investments. Regular updates and analyses can help investors stay informed about market movements and investment strategies.

Short-Term Stock Strategies

Short-term investment strategies involve buying and selling stocks with the aim of generating profits within a short timeframe. This approach requires careful monitoring of market fluctuations, sector-specific dynamics, and company-specific developments. Traders often use technical analysis tools and assess various indicators. Effective short-term strategies are about identifying opportune moments for entering and exiting stock positions to benefit from price movements.

Market Expectations for Today

Anticipating market expectations for the day involves assessing the sentiments of major investors. Analysing trends, and considering the broader economic scenario help in understanding the market direction. Announcements of key economic indicators, and global market performances play a role. Being aware of these expectations allows investors to prepare for volatility and adapt their investment plans accordingly. It also encourages proactive decision-making.

Key Market Influences

Various factors can influence the stock market, including economic data releases, shifts in global markets, and political events. For instance, any changes to interest rates, inflation figures, or significant policy decisions made by financial institutions will affect trading. Other external factors such as geopolitical events may also have an impact. Therefore, staying informed about these forces is important for investors to assess and manage risks.

Investment Recommendations

Investment recommendations from financial experts provide guidance for investors looking to create or adjust portfolios. These recommendations vary, and should include suggestions on when to buy, sell, or hold certain stocks. Analyzing these suggestions requires investors to assess their financial goals and risk tolerance. Seeking professional advice, conducting due diligence, and understanding the rationale behind such recommendations are crucial steps to take before making any investment decisions.

Making Informed Choices

Making informed investment choices involves integrating expert analysis, market data, and personal financial goals to navigate the complexities of the stock market. It's crucial for an investor to develop a well-researched strategy. Staying informed by reading financial news, attending webinars, and consulting with financial advisors is a good practice. This blend of knowledge and market awareness is essential for making sound and effective investment choices.