US PresidentDonald Trump’s threat to impose tariffs on Europe if it does not cede Greenland to the United States has sparked concern, with World Economic Forum (WEF) President and CEO Borge Brende saying he expects tough talks between the countries at Davos this week.

“I think there will be quite tough dialogues here, and frank dialogues, as they say in diplomacy, around those topics, including tariffs,” Brende told CNBC-TV18, noting that the tariff issue has persisted for almost a year between the US and different stakeholders.

With around 850 of the world’s top CEOs attending Davos this year, he said Trump remains keen on attending the forum to directly engage global business leaders.

World needs four times more investment in clean fuel to meet climate goals: WEF

Meeting the global “energy trilemma” of security, affordability and sustainability will require a sharp acceleration in investment in clean fuels, according to the World Economic Forum (WEF).

“The world is progressing on the energy trilemma, but what is really new now is the emphasis on energy security ,” said Roberto Bocca, Head of Energy and Materials at the WEF.

Ahead of the WEF’s Annual Meeting in Davos, Roberto Bocca, Head of Energy and Materials at the World Economic Forum, who is scheduled to speak later in the day, said global ambitions on clean fuels will require annual investment in production to nearly quadruple—from about $25 billion currently to close to $100 billion a year by 2030. The estimate, outlined in a WEF white paper on clean fuels, highlights the scale of capital needed to advance the global energy transition. “We will not completely phase out fuels—we will still need molecules, and clean fuels are the bridge to that future,” Bocca said.

$600 billion investment in AI marks 'fastest large-scale capital reallocation in modern history': WEF's Cathy Li

The world has invested nearly $600 billion in artificial intelligence (AI) since 2010, with the United States and China accounting for nearly two-thirds, or 65%, of the total spend, according to Cathy Li, Head of AI, Data and Metaverse and Member of the Executive Committee at the World Economic Forum (WEF).

Ahead of the WEF’s Annual Meeting in Davos, Lsaid global AI investment is expanding at an annual rate of around 33%, underscoring the rapid scale of the AI build-out worldwide. "Between 2010 and 2024, altogether, we've made $600 billion investment in AI infrastructure," Li told CNBC-TV18's Shereen Bhan. "

Global health faces $200 bn shortfall as US pullback adds pressure; AI seen as lifeline

The global health system is facing fresh funding pressure after the US stepped back from several multilateral organisations, including those linked to healthcare, according to the World Economic Forum (WEF).

Shyam Bishen, Head of the Centre for Health and Healthcare at the WEF, said funding shortages are already affecting work on health system resilience and long-term capacity building. He said the World Bank estimates the funding gap at close to $200 billion, which is required to build basic but resilient healthcare systems that can respond to risks such as climate change and future pandemics. “

Geoeconomic tensions top business risk for 2026, says WEF's Saadia Zahidi

Geoeconomic confrontation has emerged as the biggest risk facing the global economy over the next two years, according to the World Economic Forum’s (WEF) latest Global Risks Report. Saadia Zahidi, Managing Director at the WEF, said business leaders are most concerned about the US trade tariffs, investment screening, access to critical resources, and supply chains, with geopolitical and state-based conflicts also ranking high on their list of worries.

Silver on MCX crosses ₹3 lakh/kg for the first time amid rising geopolitical uncertainties

Silver has surged past ₹3 lakh per kilogram on the Multi-Commodity Exchange. The price of the metal hit the high mark of ₹3,01,315 for a kilogram on the exchange. This is the first time that silver has crossed this threshold on MCX. This comes amid geopolitical and potential trade volatility stemming from Donald Trump's threats of a flat 10% tariff on European countries that object to Greenland's accession to the US, and who support it.

Artificial Intelligence is making the global wealth gap even worse

Artificial Intelligence (AI) is likely to threaten nearly 400-800 million jobs by 2030,as per a McKinsey report. But while job losses due to AI are just gaining pace, the disruptive technology is already widening the global wealth gap. According to a new Oxfam report, billionaire wealth increased three times faster in 2025 than the average annual rate over the previous five years.

Central Asian security: An Indian perspective from a former diplomat

India’s approach to Central Asia is marked by strategic outreach, which is somewhat cautious yet marked by proactive engagement, and is also underscored by the big power contestation in the region. While there will be greater competition in times to come, India is bracing with Central Asia through connectivity, commerce, cooperation and collaboration and capacity building within the matrix of strategic autonomy and multi-alignment.

India also coordinates and consults with Russia on issues of mutual concern and is mindful of its sensitivities. There is also the talk of revival of ‘Primakov Triangle’- comprising of Russia, India and China (RIC). However, RIC interests intersect in Central Asia. Whether they will make it into a confluence or conflicting tributaries will decide the course of convergence or divergence. Meanwhile, all players, including India, will aim at harnessing their leverages in the region to their advantage,

Big earnings reports and worries around the interest rate outlook could sway markets next week

Company earnings and what happens with the interest rate outlook will unlock what's next for a broadening stock market.

Stocks are headed for a down week following an uneven start to the fourth-quarter earnings season. Of the big banks that kick off the reporting period, the retail banking players — JPMorgan, Citigroup, Bank of America, Wells Fargo — tumbled this week after disappointing investors. On the other hand, the investment firms Goldman Sachs and Morgan Stanley are higher in the latest sign that the coming year is about to be a fruitful one for dealmaking.

ICICI Pru AMC vs HDFC AMC: Same biz, two different directions

Two of India’s largest asset management companies, ICICI Prudential AMC and HDFC AMC, reported their quarterly results this week, presenting a clear contrast between faster growth driven by scale and yield, and superior profitability achieved through tight cost control.

While both AMCs delivered steady earnings growth amid supportive equity markets and resilient domestic flows, ICICI Prudential AMC outpaced its peer on revenue and profit growth. In contrast, HDFC AMC continued to lead decisively on margins.

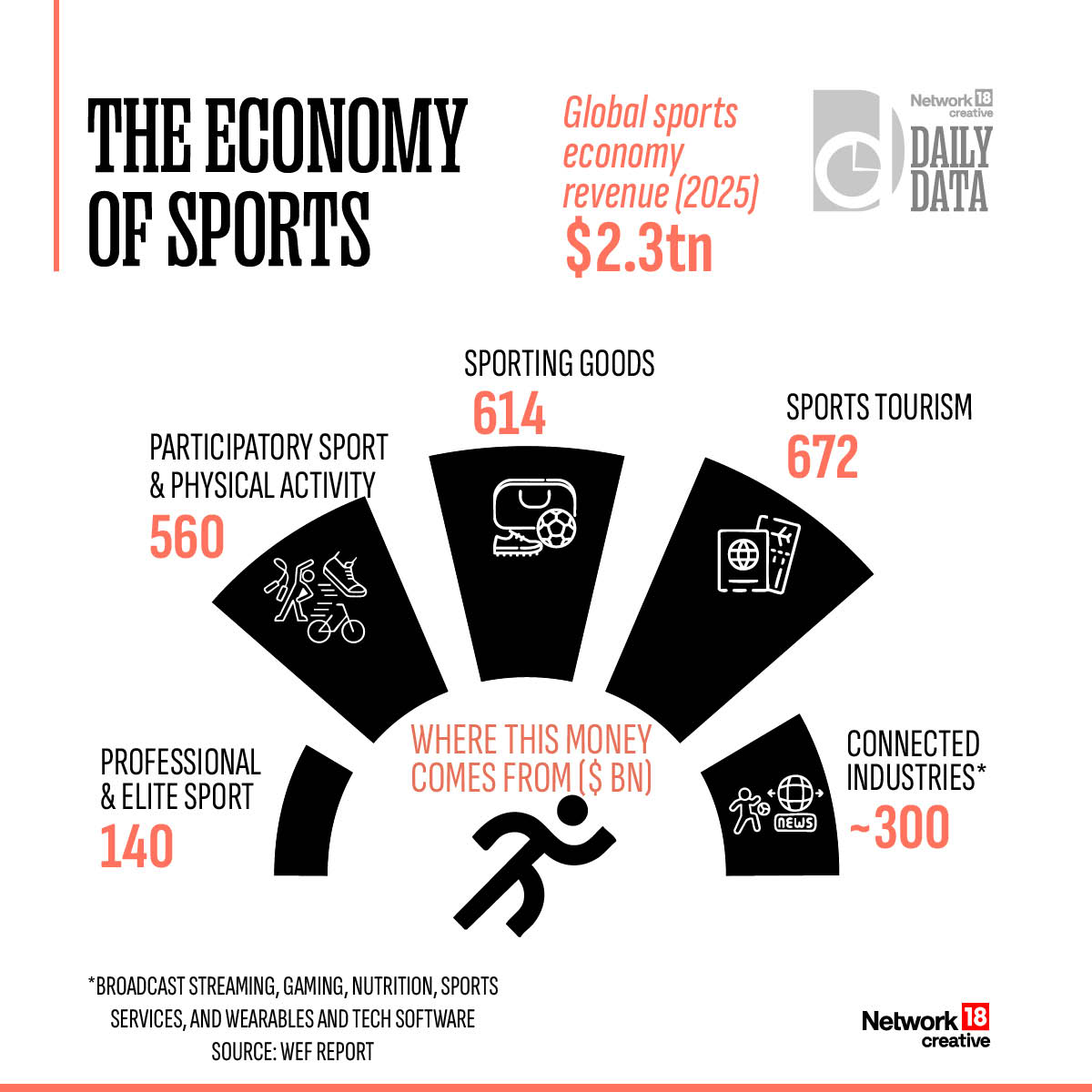

Daily Data | Sport is no longer just a game; it fuels a $2.3 Tn global business.