What is the story about?

India’s top 100 companies add record ₹148 lakh crore in 5 years: Motilal Oswal study

India recorded its strongest equity wealth-creation phase on record, with the top 100 listed companies adding ₹148 lakh crore in market value between 2020 and 2025, according to Motilal Oswal Financial Services’ 30th Annual Wealth Creation Study. The report identifies this period as the start of a prolonged compounding cycle as

the economy advances toward a projected $16 lakh crore.

Satya Nadella launches Microsoft’s cybercrime AI copilot across 1,100 Maharashtra police stations

Microsoft on Friday announced a statewide rollout of its AI-powered investigation platform for the Maharashtra Police, expanding its cybercrime copilot from a pilot in 23 Nagpur police stations to all 1,100 stations across the state.

The announcement was made during CEO Satya Nadella’s visit to India, where the company showcased several public-sector AI initiatives and positioned the country as a central hub for the development of population-scale AI systems.

Former Union Home Minister Shivraj Patil dies at 90

Senior Congress leader and former Union Home Minister Shivraj Patil died at his home town Latur in Maharashtra.

Patil, 90, died after a brief illness.

He was a former Lok Sabha Speaker and had held key portfolios in the Union Cabinet. Patil had won the Latur Lok Sabha seat seven times. Prime Minister Narendra Modi expressed grief over the death of former Union minister Shivraj Patil and said that he was passionate about contributing to the welfare of society.

Honasa Consumer forays into men's grooming, but HSBC flags scalability risk

Shares of Honasa Consumer Ltd., the parent company of beauty and skincare brand MamaEarth, are in focus on Friday, December 12, after the company acquired Reginald Men owner BTM Ventures at an enterprise value of ₹195 crore.

Honasa will buy 95% of the stake upfront in cash and the remaining 5% over the next 12 months. Reginald Men reported about ₹40,000 revenue in FY24, ₹20.1 crore in FY25 so far, and ₹74 crore on a trailing twelve-month basis.

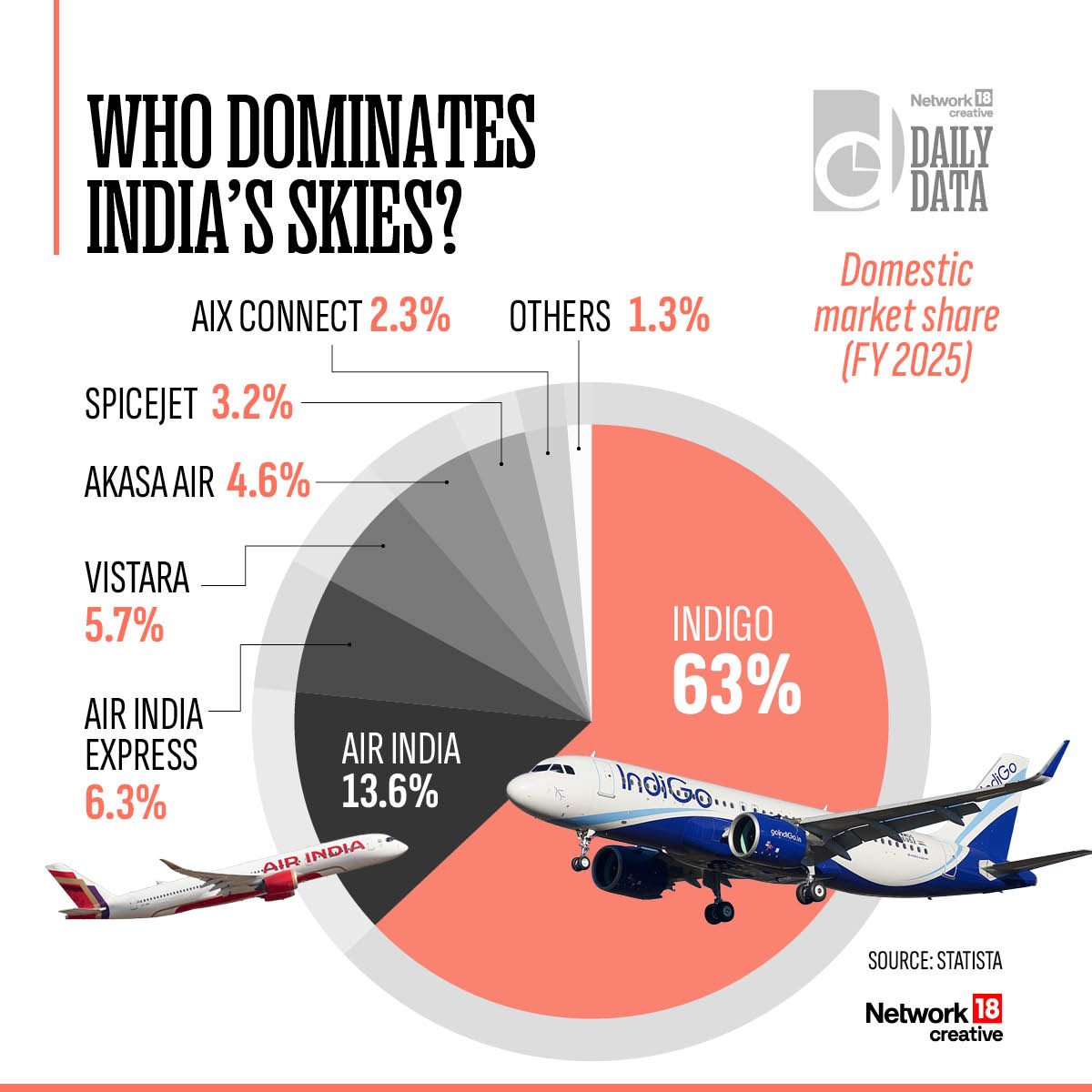

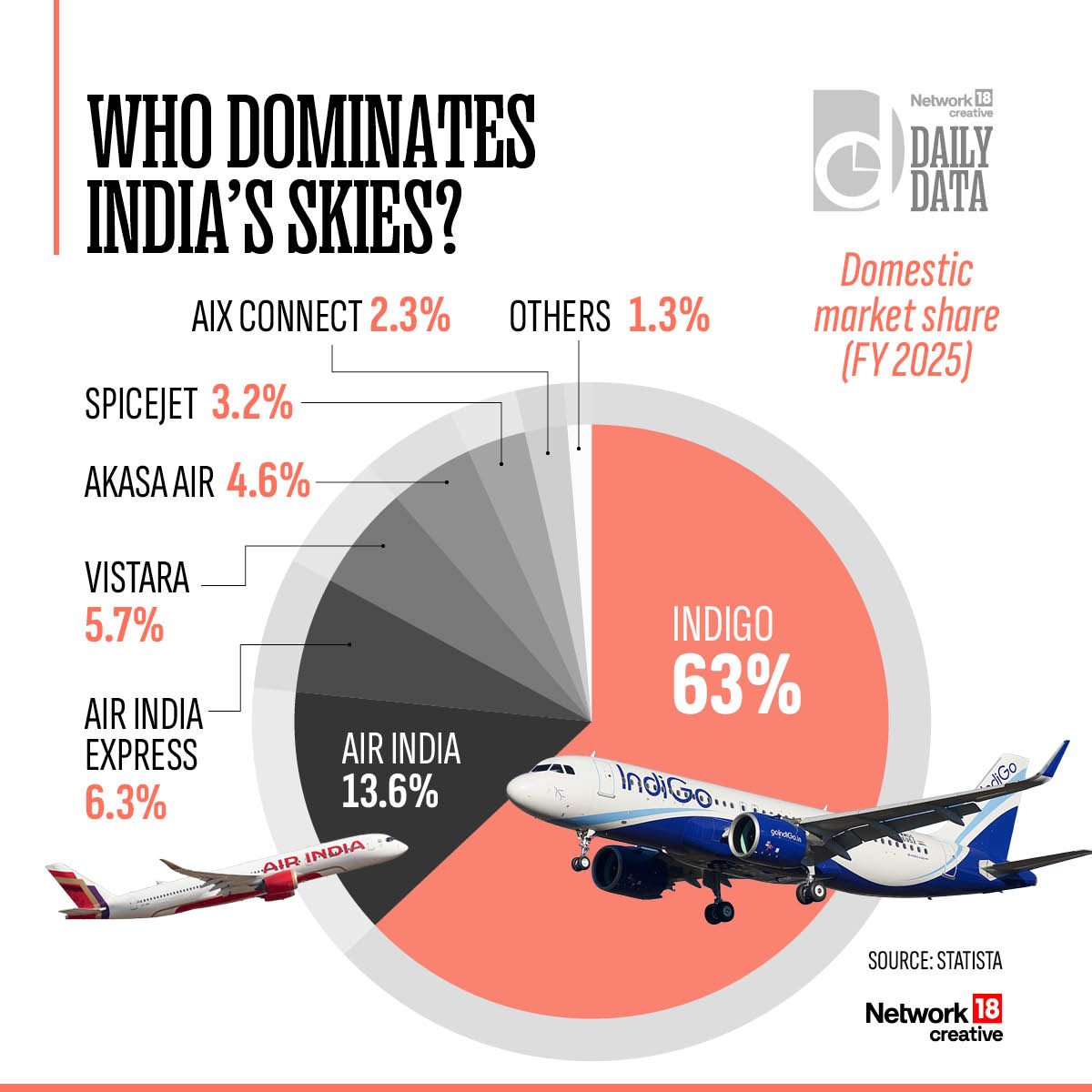

DGCA sacks four Flight Operations Inspectors for IndiGo fiasco

The Directorate General of Civil Aviation (DGCA) on Friday (December 12) sacked four Flight Operations Inspectors in relation to IndiGo's recent flight disruptions and cancellations, sources told CNBC-TV18.

Flight Operations Inspectors are responsible for overseeing airline safety, pilot training and operational compliance.

The aviation watchdog DGCA has stepped up scrutiny of the crisis-hit airline and stationed its officials at the carrier's headquarters to monitor the operations.

IndiGo share price bull, bear and base case as laid out by UBS with 31% upside potential

Shares of IndiGo continue to remain in focus on Friday, December 12, ahead of the company's CEO meeting with regulators and a writ petition being filed against the airline in the High Court.

Brokerage firm UBS has laid out three scenarios for IndiGo's future prospects, while maintaining its "buy" recommendation on the stock and a price target of ₹6,350, which implies a potential upside of 31% from Thursday's closing.

Union Cabinet expected to consider India-Oman FTA on December 12: Govt sources

Government sources have informed CNBC-TV18 that the proposed India-Oman Free Trade Agreement (FTA) is expected to be discussed by the Union Cabinet on December 12.However, an official announcement may be delayed due to procedural formalities.

Oman's democratically elected lower house, the Shura Council, had approved the proposed Comprehensive Economic Partnership Agreement (CEPA) on December 10 after concluding deliberations

Why Berkshire Hathaway is the ultimate case study for Indian investors, according to Ramesh Damani

Berkshire Hathaway’s rise from a $75 stock in 1977 to nearly $750,000 today is not just an American investing legend—it is, in Ramesh Damani’s view, the purest illustration of what most Indian investors still fail to understand: the transformative power of long-duration compounding.

Speaking to CNBC-TV18’s Prashant Nair at Motilal Oswal’s 30th Wealth Creation Study event, Damani, Member, BSE, said Berkshire remains the global benchmark for patient capital and the single most powerful example of how sustained compounding—not clever timing—creates generational wealth. “The point is not that Berkshire compounded; it’s that it compounded uninterrupted for 45 years. That longevity is what creates extraordinary wealth,” he said.

Buffett’s 15-stock philosophy taught me the real power of compounding: Raamdeo Agrawal

Raamdeo Agrawal, Chairman of Motilal Oswal Financial Services, says Warren Buffett’s disciplined approach to concentrated portfolios fundamentally reshaped his own investment strategy andtaught him the true meaning of compounding.

Speaking to CNBC-TV18’s Prashant Nair at Motilal Oswal’s 30th Wealth Creation Study event, Agrawal said his shift from a sprawling 225-stock portfolio to a tightly managed 15–20-stock basket in the mid-1990s was the turning point in his investing life.

An early investor in Meesho writes: Liquidity is back!

“You cannot predict, you can prepare.” — Howard Marks.

This month did not reward prediction. It rewarded preparation. India’s consumer-tech ecosystem just witnessed its strongest liquidity burst in years.

Meesho’s spectacular public debut, closing over 50% higher on day one at a valuation near $8.8 billion, was followed within hours by Swiggy’s $1.1 billion qualified institutional placement (QIP), oversubscribed by global and domestic institutions, according to a Mint report citing sources.

Two different funding and liquidity paths arrive in the same 24-hour cycle. Together, they signal something larger: India’s consumer-tech capital window is open again—selectively, but decisively.

News In Numbers

India recorded its strongest equity wealth-creation phase on record, with the top 100 listed companies adding ₹148 lakh crore in market value between 2020 and 2025, according to Motilal Oswal Financial Services’ 30th Annual Wealth Creation Study. The report identifies this period as the start of a prolonged compounding cycle as

Satya Nadella launches Microsoft’s cybercrime AI copilot across 1,100 Maharashtra police stations

Microsoft on Friday announced a statewide rollout of its AI-powered investigation platform for the Maharashtra Police, expanding its cybercrime copilot from a pilot in 23 Nagpur police stations to all 1,100 stations across the state.

The announcement was made during CEO Satya Nadella’s visit to India, where the company showcased several public-sector AI initiatives and positioned the country as a central hub for the development of population-scale AI systems.

Former Union Home Minister Shivraj Patil dies at 90

Senior Congress leader and former Union Home Minister Shivraj Patil died at his home town Latur in Maharashtra.

He was a former Lok Sabha Speaker and had held key portfolios in the Union Cabinet. Patil had won the Latur Lok Sabha seat seven times. Prime Minister Narendra Modi expressed grief over the death of former Union minister Shivraj Patil and said that he was passionate about contributing to the welfare of society.

Honasa Consumer forays into men's grooming, but HSBC flags scalability risk

Shares of Honasa Consumer Ltd., the parent company of beauty and skincare brand MamaEarth, are in focus on Friday, December 12, after the company acquired Reginald Men owner BTM Ventures at an enterprise value of ₹195 crore.

Honasa will buy 95% of the stake upfront in cash and the remaining 5% over the next 12 months. Reginald Men reported about ₹40,000 revenue in FY24, ₹20.1 crore in FY25 so far, and ₹74 crore on a trailing twelve-month basis.

DGCA sacks four Flight Operations Inspectors for IndiGo fiasco

The Directorate General of Civil Aviation (DGCA) on Friday (December 12) sacked four Flight Operations Inspectors in relation to IndiGo's recent flight disruptions and cancellations, sources told CNBC-TV18.

Flight Operations Inspectors are responsible for overseeing airline safety, pilot training and operational compliance.

The aviation watchdog DGCA has stepped up scrutiny of the crisis-hit airline and stationed its officials at the carrier's headquarters to monitor the operations.

IndiGo share price bull, bear and base case as laid out by UBS with 31% upside potential

Shares of IndiGo continue to remain in focus on Friday, December 12, ahead of the company's CEO meeting with regulators and a writ petition being filed against the airline in the High Court.

Brokerage firm UBS has laid out three scenarios for IndiGo's future prospects, while maintaining its "buy" recommendation on the stock and a price target of ₹6,350, which implies a potential upside of 31% from Thursday's closing.

Union Cabinet expected to consider India-Oman FTA on December 12: Govt sources

Government sources have informed CNBC-TV18 that the proposed India-Oman Free Trade Agreement (FTA) is expected to be discussed by the Union Cabinet on December 12.However, an official announcement may be delayed due to procedural formalities.

Oman's democratically elected lower house, the Shura Council, had approved the proposed Comprehensive Economic Partnership Agreement (CEPA) on December 10 after concluding deliberations

Why Berkshire Hathaway is the ultimate case study for Indian investors, according to Ramesh Damani

Berkshire Hathaway’s rise from a $75 stock in 1977 to nearly $750,000 today is not just an American investing legend—it is, in Ramesh Damani’s view, the purest illustration of what most Indian investors still fail to understand: the transformative power of long-duration compounding.

Speaking to CNBC-TV18’s Prashant Nair at Motilal Oswal’s 30th Wealth Creation Study event, Damani, Member, BSE, said Berkshire remains the global benchmark for patient capital and the single most powerful example of how sustained compounding—not clever timing—creates generational wealth. “The point is not that Berkshire compounded; it’s that it compounded uninterrupted for 45 years. That longevity is what creates extraordinary wealth,” he said.

Buffett’s 15-stock philosophy taught me the real power of compounding: Raamdeo Agrawal

Raamdeo Agrawal, Chairman of Motilal Oswal Financial Services, says Warren Buffett’s disciplined approach to concentrated portfolios fundamentally reshaped his own investment strategy andtaught him the true meaning of compounding.

Speaking to CNBC-TV18’s Prashant Nair at Motilal Oswal’s 30th Wealth Creation Study event, Agrawal said his shift from a sprawling 225-stock portfolio to a tightly managed 15–20-stock basket in the mid-1990s was the turning point in his investing life.

An early investor in Meesho writes: Liquidity is back!

“You cannot predict, you can prepare.” — Howard Marks.

This month did not reward prediction. It rewarded preparation. India’s consumer-tech ecosystem just witnessed its strongest liquidity burst in years.

Meesho’s spectacular public debut, closing over 50% higher on day one at a valuation near $8.8 billion, was followed within hours by Swiggy’s $1.1 billion qualified institutional placement (QIP), oversubscribed by global and domestic institutions, according to a Mint report citing sources.

Two different funding and liquidity paths arrive in the same 24-hour cycle. Together, they signal something larger: India’s consumer-tech capital window is open again—selectively, but decisively.

News In Numbers