By Eric Onstad and Sarah Qureshi

LONDON/BENGALURU, Jan 29 (Reuters) - Analysts have boosted their consensus 2026 price forecast for copper above $11,000 for the first time after the market surged to all-time

highs, but are wary about speculative excess and expect prices to average well below the peaks, a Reuters poll shows..

Benchmark copper on the London Metal Exchange hit an all-time high above $14,000 per metric ton on Thursday, fuelled by speculators in the wake of mine disruptions that may cause shortages.

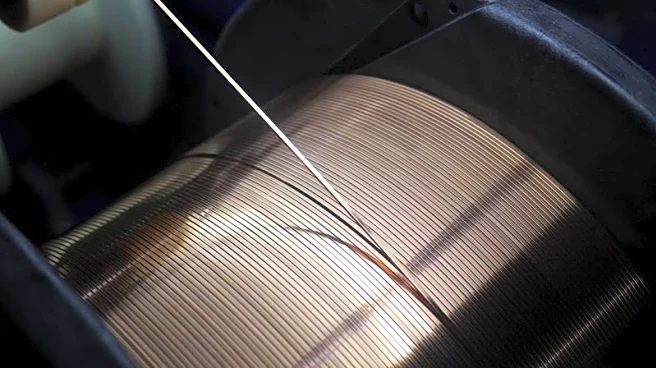

Copper, used in power and construction and often seen as a barometer of the global economy with applications in data centres for artificial intelligence and global clean energy transition, rose 42% last year and has gained 12% so far in January. But some investors worry that industrial demand may weaken.

The LME cash copper contract should average $11,975 per metric ton in 2026, a median forecast of 31 analysts showed, up 14% from $10,500 forecast in the previous poll in October. The median forecast is the highest annual consensus ever in a Reuters poll and the first time above the $11,000 mark, according to Reuters data.

"We expect copper to trade in a new higher normal range, but looking across the year, we see prices for copper above $13,000 per ton as unsustainable," said Natalie Scott-Gray at StoneX.

"We have to remember that when we start to reach extreme levels, this is often accompanied by sharp reversals and we expect this to be the key area to watch."

With worries about mine disruptions, such as at the world's second-biggest copper mine, Grasberg in Indonesia, analysts boosted their consensus forecast of a market deficit this year to 238,500 tons from 150,000 tons in the previous poll.

They expect the deficit to decline in 2027 to 116,000 tons.

FOCUS ON CHINA ALUMINIUM CAP

The price of aluminium - which is used for transport, construction and packaging - has also jumped, surging 27% over the past six months and hitting its highest since April 2022.

China has been in focus since output last year in the world's top producer touched a government-imposed cap of 45 million tons a year.

"Aluminium has also been drawn into the speculative frenzy that has been pushing prices higher," said Carsten Menke at Julius Baer.

"We see prices trading at the upper end of a fundamentally justified range, more likely seeing downside than additional upside."

LME cash aluminium is expected to average $2,946 a ton in 2026, up 10% from the forecast in the previous poll, but below Wednesday's closing price of $3,252.

Analysts marked down their market balance surplus consensus in 2026 to 80,000 tons from 250,000 tons in the previous poll.

INDONESIA SPURS NICKEL PRICE

Nickel prices languished during most of 2025 as investors worried about large amounts of capacity being added in the world's largest producer Indonesia.

But since mid-December, nickel has jumped by 27% to 18-month highs after Indonesia's government said it would cut output quotas.

"All eyes are on Indonesia, which plans to revert to one-year from three-year production quotas intended to strengthen oversight and curb oversupply," said independent analyst Robin Bhar.

Analysts expect LME cash nickel to average $15,988 a ton in 2026, up 2% from the previous poll forecast but down 11% from Wednesday's closing price of $18,048.

They have increased their consensus for a global nickel surplus in 2026 to 214,000 tons from 156,500 previously.

(Reporting by Eric Onstad and Sarah Qureshi; Editing by Emelia Sithole-Matarise)