By Inti Landauro, Andres Gonzalez, Joanna Plucinska and Ceyda Caglayan

SEVILLE/LONDON/ISTANBUL (Reuters) -Turkish Airlines' surprise deal for a stake in Spanish carrier Air Europa, outlasting European rivals

Lufthansa and Air France-KLM, was in large part down to its willingness to share control of the carrier with the airline's Hidalgo family owners, four sources told Reuters.

The deal, a rare stake inside Europe by a non-European carrier, comes as airlines are looking to consolidate the continent's fragmented market and snap up smaller struggling operators like Scandinavia's SAS and Italy's ITA Airways.

Air France-KLM and Lufthansa, however, wanted more control of Air Europa, the sources close to the deal said. Turkish Airlines - looking to boost its global reach and with deeper pockets and political backing - was willing to stick with a smaller stake.

Turkish Airlines has agreed to invest 300 million euros ($355.11 million) in convertible debt, equivalent to a stake of 25-27% in Air Europa, Turkish Airlines' Chairman Ahmet Bolat said on Wednesday, with no intention to increase that stake.

The crunch factor in talks - previously unreported - points to Turkish Airlines' willingness to yield influence in order to gain a toehold in Iberia, which opens up important and fast-growing routes to regions such as Latin America.

A source with knowledge of the deal told Reuters that Lufthansa and Air France-KLM both demanded "a path to control" within a few years, which the Hidalgo family didn't want to accept. The Turkish deal was a "better fit", the source added.

Three other sources confirmed the issue of a controlling stake prompted both Air France-KLM and Lufthansa to drop out of the deal. One of the sources said Air Europa's valuation of up to 1.2 billion euros was also seen as too high.

Lufthansa did not respond to a Reuters request for comment.

An Air France-KLM spokesperson said the carrier dropped out as no agreement on key elements could be reached with Air Europa's owner Globalia, without commenting on whether it wanted a majority stake.

Globalia's Javier Hidalgo, the son of chairman Juan Jose Hidalgo, declined to comment when approached by Reuters.

The deal with Turkish Airlines is unconventional - it's rare for non-European airlines to take a stake in European carriers, particularly because European Union rules prevent them from taking majority ownership in an EU airline.

Air Europa was always a complex case to navigate in competition terms given British Airways owner IAG's 20% stake, while the benefits for Turkish Airlines are less financial and more about geopolitics and connectivity, analysts and executives said.

"(The) risks of taking minority stakes include a lack of control, and a reduced ability to influence strategy," said Neil Glynn, an analyst at Alvarez and Marsal.

Air France-KLM and Lufthansa balked at the complexity of having to balance so many controlling parties. IAG previously tried to buy out the entirety of Air Europa but scrapped the plan last year over regulatory concerns.

BUSINESS STRATEGY OR STATE PLAN?

Turkish Airlines has touted the deal as an opportunity to expand into two of its least penetrated markets - Iberia and Latin America - and link them with its hub-and-spoke network.

There's also political clout behind it. Turkish Transport Minister Abdulkadir Uraloglu appeared with the airline in Seville this week to tout the deal, saying it would fit with a broader "strategy" to connect Turkey with the world.

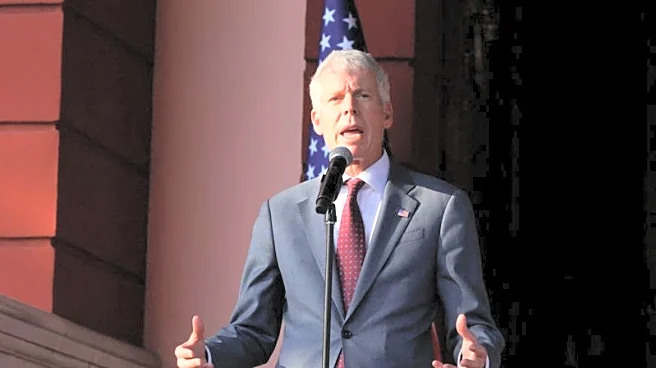

Turkish Airlines' Ahmed Bolat told reporters that the move was a business decision, even if the Turkish government did have the firm's ear.

"(Turkish) listens to and takes into account the state's strategies, but its strategies are made privately," he said.

The Turkish carrier has few financial challenges that could derail its relatively small stake. The group's forecast net debt to EBITDAR ratio for 2025 is 1.60, a similar ratio to Lufthansa and Air France-KLM, though the latter have less backing from their national governments and weaker balance sheets.

"I don't think it will cause any problems in terms of its balance sheet," said Erdem Kayli, research director at TEB Investment/BNP Paribas.

($1 = 0.8448 euros)

(Reporting by Inti Landauro, Andres Gonzalez, Joanna Plucinska and Ceyda Caglayan; Additional reporting by Tim Hepher; Editing by Adam Jourdan and Susan Fenton)