By Sabrina Valle

NEW YORK, Dec 19 (Reuters) - Union Pacific and Norfolk Southern on Friday filed a nearly 7,000‑page merger application with the U.S. Surface Transportation Board (STB), triggering a 30‑day period in which the regulator can seek more information or propose initial remedies as it reviews their plan to create the nation’s first coast‑to‑coast freight railroad.

The filing also opens a formal window for stakeholders to respond to the $85 billion transaction, including shippers, labor unions,

rival railroads, consumer advocates and local officials, who can support, oppose or seek conditions as the STB evaluates its competitive and public‑interest impact.

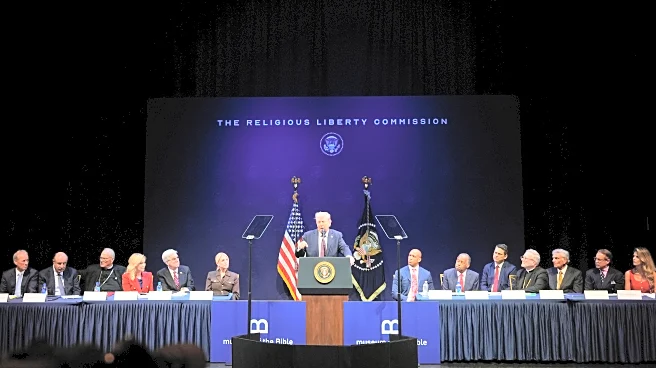

Union Pacific and Norfolk Southern agreed to merge in July in a deal that surprised analysts and industry executives. They said such a proposal, which received public support from President Donald Trump, would have faced tougher antitrust scrutiny under earlier administrations.

Union Pacific was among the corporations that contributed to Trump’s White House ballroom project, public disclosures show. UP Chief Executive Jim Vena also met Trump in the Oval Office in September to discuss the merger, a meeting both sides confirmed. Vena and Trump have said creating a single East‑West railroad aligns with the president’s vision to “make America great again.”

CONSOLIDATION

The proposal has drawn strong opposition from competitors in an already concentrated industry. Four Class I freight railroads dominate the U.S. market, with Union Pacific and BNSF controlling most western routes and Norfolk Southern and CSX covering the East.

UP and NS argue the combination would eliminate the East‑West handoff barrier — especially the costly, delay‑prone Chicago interchanges — by providing single‑line service. They say this would reduce handoffs, improve transit times and help rail compete more effectively with long‑haul trucking.

Union Pacific CEO Jim Vena said he is confident the deal will get regulatory approval.

“If we stand still, we are going to get left behind. I'm not into that. The benefits of this transaction are undeniable,” Vena said.

BNSF, owned by billionaire Warren Buffett's Berkshire Hathaway, has argued the merger would reduce shipper choices and lead to higher rates, warning it would create “a railroad of such enormous scope” that it could undermine competition across key corridors.

Canadian Pacific Kansas City (CPKC) has also criticized the deal, with its CEO saying the company was not interested in further consolidation and questioning whether a transcontinental combination of this scale serves the public interest.

But the future of rail consolidation is still fluid, Hatch said. CSX, BNSF and Canadian Pacific will review Friday's filing and could eventually pair up in response to the UP–NS bid, depending on what competitive concessions, market access or operating advantages the STB ultimately grants, he said.

“If these railroads get enough market access through the STB process, they may decide they can remain independent — and if they don’t, they risk being outmatched unless they merge.”

CSX is reviewing the filing and will participate in the STB process to ensure it remains well positioned to compete, the company said.

The UP–NS transaction is the first major railroad merger to be reviewed under the stricter STB framework adopted in 2001, which requires railroads to prove a merger will enhance competition — not just preserve it — and show clear public‑interest benefits, Hatch said.

(Reporting by Sabrina Valle in New YorkEditing by Nick Zieminski)