By Casey Hall

SHANGHAI, Jan 28 (Reuters) - China's so-called second-tier cities are fast becoming the first stop for luxury goods vendors as middle-class consumers seek high living standards in lower-cost

locales, taking with them their penchant for pricey parkers and expensive extras.

With luxury spending in places like Nanjing, Changsha and two dozen other middling cities exceeding that of a handful of economic powerhouses such as Beijing and Shanghai, bling brands like Burberry and Louis Vuitton owner LVMH are following the money and booking sales that point to a recovery in China's battered luxury sector.

"The fact that you have all these second-tier cities now in the top 10 (luxury sales) ranking - it's crazy if you think about it," said Zino Helmlinger, head of China retail at CBRE.

China accounts for roughly a quarter of luxury spending but sales have been sluggish since the end of a post-pandemic boom while weak economic growth and fallout from a property sector crisis continue to trickle down to the shopper on the street.

However, Burberry last week said China's Generation Z helped revenue beat analyst expectations while LVMH on Tuesday flagged a recovery in China with forecast-beating fourth-quarter sales.

Notably, in August, when Louis Vuitton launched beauty line "La Beauté Louis Vuitton" in China, it made its eye shadow, lip balm and 1,200 yuan ($172) lipstick first available not in a first-tier city but at Nanjing Deji Plaza.

Months earlier, data showed Nanjing Deji Plaza had, for the first time, leapfrogged long-time luxury mall leader Beijing SKP to become China's top-performing high-end shopping centre.

The mall, in the Jiangsu provincial capital of 9.5 million people, booked sales of more than 24.5 billion yuan in 2024 compared to Beijing SKP's 22.2 billion yuan, state media said. Moreover, it likely stayed at the top in 2025, analysts said.

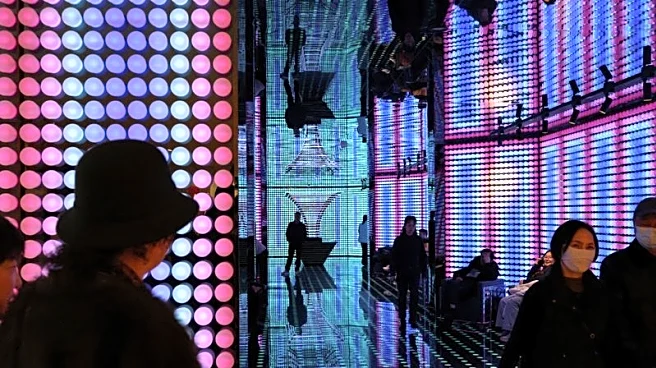

The mall has an art museum, modern food hall and 500 square metre (5,382 square feet) restrooms with themes such as calligraphy, classical music and cyberpunk.

So elaborate are the restrooms that they have gone viral on social media, and brands including Self-Portrait and Estee Lauder's MAC Cosmetics have had pop-up shops in them.

"There are many delicious types of food and the selection of shops is excellent," 24-year-old Zhou Shiyong said of Nanjing Deji Plaza. "Only Deji has this kind of assortment; other shopping malls don't have it, which is why we come to Deji."

DEJI 'DOMINATES COMMERCIAL EFFICIENCY'

Second-tier cities such as Nanjing are becoming increasingly important to luxury brands as a growing contingent of middle-class people shun more economically developed first-tier cities such as Beijing and Shanghai to benefit from lower living costs.

Latest research from insights firm MDRi showed luxury shoppers in second-tier cities spent an average of 253,800 yuan in 2024, up 22% from the previous year and surpassing first-tier consumers, whose spending fell 4% to 250,200 yuan.

Top brands are chasing these consumers as they move further afield from previous growth markets and, in the case of Burberry, trying out new methods of marketing such as setting up a branded ice rink and a pop-up shop on a ski slope.

"Recent earnings suggest a modest recovery, and part of that is due to more active investment - flagship experiences in first-tier cities, and more targeted, performance-led strategies in the top malls in lower-tier cities," said James Macdonald, head of Savills research for China.

Deji, owned by real estate conglomerate Deji Group, is the Nanjing region's only mall to house every major luxury brand. It also offers more accessible labels aimed at Gen Z shoppers - an increasingly powerful force in the luxury sector as brands seek to tap shifting tastes among fickle younger consumers.

"Deji has the highest luxury sales density in China. They have an ultra-strong VIP ecosystem, deep brand partnerships, frequent store upgrades and they basically dominate commercial efficiency," said CBRE's Helmlinger.

"Brands would rather wait for a location there than go to another project just a few kilometres away."

MALLS IN SECOND-TIER CITIES CLIMB LUXURY RANKS

Malls in other second-tier cities - such as Changsha IFS, Wuhan Wushang and Hangzhou In77 - are also rising in luxury sales ranking, Helmlinger said.

Their ascendancy is partly economic. McKinsey research released last year showed that, in China, consumers in the biggest cities were most likely to cut discretionary spending.

Consumer confidence was stronger among young and middle-income shoppers in second-tier cities, where living costs are lower and local job security firmer, the research showed.

Many second-tier cities have also seen their middle-class population boosted by a net inflow of people from top-tier centres, Savills' Macdonald said.

Demographic and economic shifts aside, Helmlinger said top malls in second-tier cities have significantly improved their offerings, giving nearby consumers access to brands without having to travel to Shanghai or Beijing.

"It really shows China is going through a wide change in consumer behaviour, and in where money is localised and spent," said Helmlinger. "In the coming few years we're going to see many more second-tier cities rising, because that's where the money is."

($1 = 6.9554 Chinese yuan renminbi)

(Reporting by Casey Hall; Additional reporting by Xihao Jiang and Chenxi Yang in Shanghai; Editing by Anne Marie Roantree and Christopher Cushing)