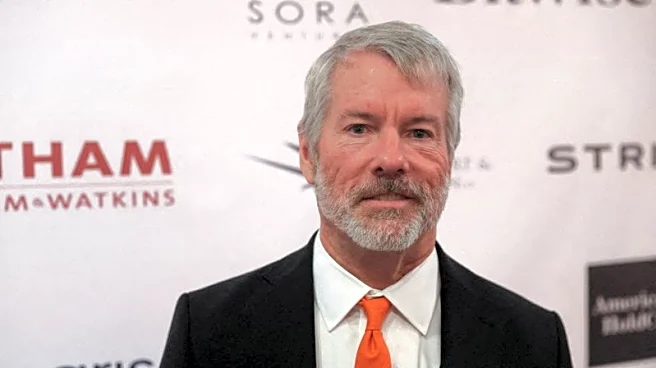

Jan 7 (Reuters) - Shares of billionaire Michael Saylor's Strategy rose 6% in premarket trading on Wednesday, after MSCI dropped a plan to exclude the bitcoin hoarder and other crypto treasury firms from its indexes.

Digital asset treasury companies, often called DATCOs, surged in popularity in 2025 as a wave of firms began holding crypto tokens such as bitcoin, ether and solana as their main treasury assets, lifting prices and giving investors a proxy for direct exposure.

Despite their popularity,

the tokens remain prone to sharp price swings and shares of most firms have stayed volatile. The accounting treatment is also unsettled, with analysts and industry experts debating whether these companies should be viewed primarily as holding vehicles or assessed based on their underlying businesses.

"For now, MSCI will maintain the current index treatment for DATCOs with digital asset holdings representing 50% or more of total assets," analysts at J.P. Morgan wrote in a note.

Index provider MSCI had proposed removing DATCOs from its global benchmarks in the fall, on the grounds they resemble investment funds, which are not included in its indexes. The move had fueled broader concerns other major stock index providers could take a similar stance.

Many such firms countered they are operating companies developing new products, and that MSCI's proposals unfairly single out crypto.

"MSCI intends to open a broader consultation on the treatment of non-operating companies generally... we suspect exclusion is postponed until later in the year," said Mike O'Rourke, chief market strategist at JonesTrading.

Shares in Strategy, which began as software firm MicroStrategy, surged after it started buying bitcoin in 2020. It was the first among DATCOs, helping spark a crypto treasury frenzy that later spread to dozens of other firms.

Its stock closed 2025 down 47.5% as bitcoin prices slumped.

(Reporting by Manya Saini and Shashwat Chauhan in Bengaluru; Editing by Krishna Chandra Eluri)