Feb 4 (Reuters) - Eli Lilly forecast 2026 profit and revenue above Wall Street estimates on Wednesday and beat estimates for quarterly earnings as the world's most valuable drugmaker sees strong demand for its obesity drugs.

Shares of the company rose over 7% in premarket trading.

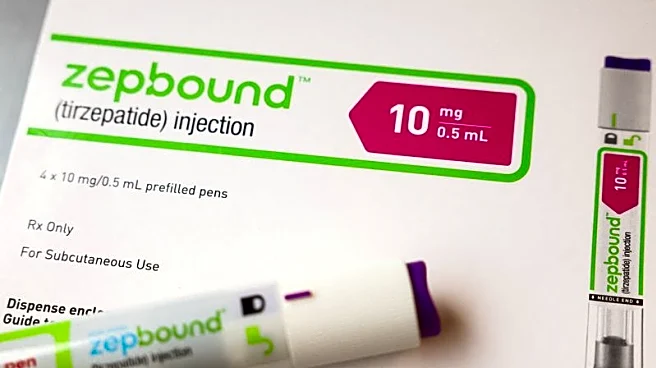

Lilly last year became the first pharmaceutical company to hit a $1 trillion valuation, driven by the popularity of its weight-loss drug, Zepbound, in a rapidly expanding obesity market that is seeing newer avenues to bolster

growth.

Lilly's upbeat outlook stands in sharp contrast to that of rival Novo Nordisk, which has warned of "unprecedented" price pressures in 2026 after rattling investors with a forecast for a steep sales drop this year.

For the fourth quarter, the drugmaker reported a profit of $7.54 per share. Analysts were expecting $6.67, according to data compiled by LSEG. Revenue increased to $19.3 billion, ahead of Wall Street expectations of $17.96 billion.

Lilly expects to earn $33.50 to $35 per share on an adjusted basis this year, above analysts' average estimate of $33.23 per share. Sales are expected to be in the range of $80 billion to $83 billion, ahead of estimates of $77.62 billion.

PRICING PRESSURES

Investor focus is squarely on how Lilly will navigate mounting pricing pressure after its deal with the Trump administration, which expanded access to its obesity treatments in return for steep price cuts.

Sales of diabetes drug Mounjaro came in at $7.41 billion for the fourth quarter, compared with analysts' expectations of $6.63 billion.

Zepbound clocked in sales of $4.3 billion for the quarter, above estimates of $3.41 billion.

Lilly said lower prices tempered sales despite strong demand for the drugs.

Novo Nordisk has warned that its own agreement with the U.S. government will shave 2% to 4% off revenue this year, while Lilly has said higher patient volumes should help cushion the impact of lower prices.

Focus is also building around the expected launch of Lilly's oral weight-loss pill, orforglipron.

At the same time, both companies are moving aggressively in the cash-pay market. Novo is selling lower doses of its daily pill in the United States for $149 a month, rising to $199 from April. Lilly, for its part, plans to cap the price of higher doses of its obesity pill, if approved, at $399 a month for repeat cash-paying patients.

Lilly continues to be "the company to try to catch up with" in the weight-loss drug space, Morningstar analyst Karen Andersen told Reuters ahead of the results.

(Reporting by Mariam Sunny in Bengaluru; Editing by Anil D'Silva)