By Samuel Shen and Summer Zhen

SHANGHAI/HONG KONG (Reuters) -China's stock market is on a tear supported by state money and big institutions, and analysts say the absence of retail investor euphoria suggests

the rally has legs even as the economic recovery struggles to gather pace.

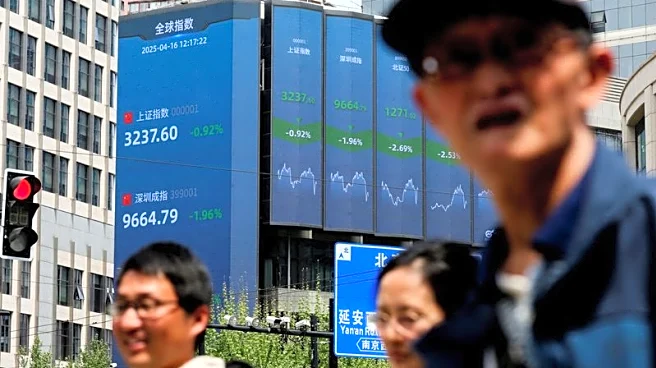

The benchmark Shanghai Composite Index is up by a quarter since April and at 10-year highs, a stark contrast to China's economy which remains mired in a property crisis, weak consumption and a deflationary spiral.

Analysts are bullish, noting how the rally has been driven so far mainly by sovereign funds, insurers and other institutions, and the early signs of retail investor buying.

"Stocks can go up even in a slowing economy" as fresh inflows can lift valuations, said Chen Haoyang, a Shanghai-based fund manager at Leader Capital.

"The money-making effect is just emerging. If you look around, not everyone is itching to buy stocks. The mood is not yet boiling so we can be a bit more daring."

Chinese households reluctant to spend or invest in a struggling economy sit on a record 160 trillion yuan ($22.33 trillion) worth of savings - triple the size a decade ago and worth 60% more than the total value of the mainland stock markets.

But some of that cash is moving out of banks and into trading accounts. Individual deposits shrank by 1.1 trillion yuan in July, while deposits at non-banking financial institutions jumped by 2.1 trillion yuan.

"Our clients are moving money out of deposits and bonds because interest rates keep falling," said Max Gu, a manager at a Citic Securities outlet in Shanghai.

Among those seeking to gauge potential flows into stocks, Kaiyuan Securities estimates retail deposits worth 2.1 trillion yuan are maturing this year and the next and could now flow into higher-yielding stocks and funds. Sealand Securities forecasts retail dry powder of 1.84 trillion yuan.

Chinese 10-year treasuries now yield roughly 1.7% while banks offer interest rates of less than 1% for one-year deposits. The bluechip CSI300 Index gives a dividend yield of around 2.5% even after the recent rally.

"At some point, the stock market rally could attract new investors and new funding, resulting in a self-fulfilling process," Nomura analysts said in a report.

BOOM HAS FIRM UNDERBELLY

The boom in stock prices has drawn parallels with 2015, when similar economic circumstances spurred policy easing and a market surge, only to result in disappointment and a crash a year later.

This time is different, analysts said, noting that while the economy is struggling, the money chasing stocks is long-term and institutional, rather than retail borrowings that rushed quickly for the exit in 2015.

The rally seems tenacious, fund managers and analysts say, underpinned by state-backed funds, confidence in artificial intelligence firm DeepSeek's success, and a truce in the bruising Sino-U.S. trade war.

Nevertheless, the divergence between weakening economic fundamentals and growing investor exuberance creates a dilemma for policymakers seeking to stimulate the economy without fanning a stock market bubble. Broad-based weakness in July data shows the economy continues to decelerate.

Beijing may need to tread carefully in the next couple of months as "rolling out pro-growth measures could fan the flames and inflate a stock market bubble," Nomura said. "However, doing nothing could risk worsening the growth slowdown."

Citic's Gu said there are few signs of retail frenzy. "Many funds are still under the water, and many investors are still licking their wounds."

Shanghai Stock Exchange data shows 1.9 million new retail accounts were opened in July, much smaller than 7 million per month during the height of the 2015 market boom.

China's daily stock trading turnover has exceeded 2 trillion for 11 consecutive sessions, the longest streak on record. The balance of margin financing has hit a decade-high of 2.1 trillion yuan.

But margin trading accounts for just 2.2% of China's floating market cap, half of the levels in 2015, when the market was much smaller.

"There are still some shortcomings in the economy that deter a more aggressive positioning on the overall market," said Homin Lee, Singapore-based strategist at Swiss private bank Lombard Odier.

"If you only focus on 2025, it looks exciting. But if you look at longer history, it has been a terrible investment for investors."

($1 = 7.1651 Chinese yuan renminbi)

(Reporting by Samuel Shen in Shanghai, Jiaxing Li and Summer Zhen in Hong KongEditing by Vidya Ranganathan and Shri Navaratnam)