(Reuters) -Figure Technology Solutions' revenue surged 22% in the first half of 2025, the blockchain lender disclosed on Monday in its U.S. initial public offering paperwork, the latest crypto-linked firm set to hit the new listings market.

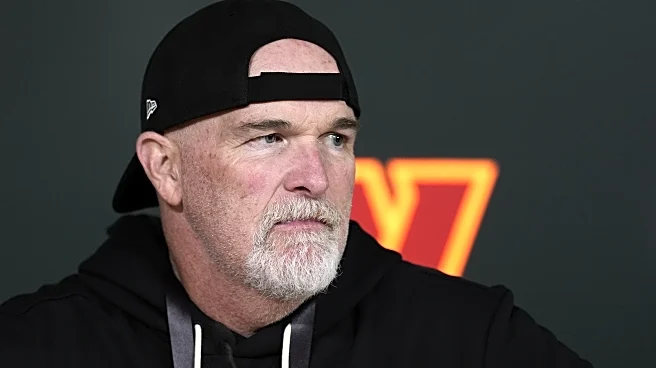

The company, co-founded in 2018 by technology entrepreneur Mike Cagney and his wife June Ou, is a blockchain-native capital marketplace that connects origination, funding, and secondary market activity.

The New York-based company and some of its existing stockholders

plan to sell shares in the offering.

With the IPO calendar set for a seasonal slowdown through the end of August, corporate issuers are lining up for a potential roadshow launch after Labor Day when the new listings market kicks back into action.

Winklevoss twins' crypto exchange, Gemini, also publicly filed for New York IPO last week.

Figure's revenue surged 22.4% to $191 million in the six months ended June 30. The company reported a profit of $29 million, compared with a loss of $13 million in the same period a year earlier.

Cagney was also the co-founder of fintech SoFi and stepped down as the firm's CEO in 2018.

Figure's loan origination system and capital marketplace is used by more than 160 partners.

In 2021, Figure raised $200 million in a funding round at a$3.2 billion valuation. Earlier this month, Figure said it had confidentially filed for a New York IPO.

Goldman Sachs, Jefferies and BofA Securities are the lead underwriters for the offering.

Figure will list on the Nasdaq under the symbol "FIGR". Proceeds from the offering will be used for general purposes.

(Reporting by Arasu Kannagi Basil in Bengaluru; Editing by Maju Samuel)