By Prakhar Srivastava

Feb 2 (Reuters) - Cboe Global Markets is in the early stages of exploring a new regulated product that would use an options structure to offer all-or-none payouts, a source familiar with the matter told Reuters on Monday.

The concept involves a binary-style payoff that would deliver a fixed return if a specified condition is met and nothing if it is not.

The move would position the exchange to compete with fast-growing prediction market platforms, which have exploded in popularity

since the last U.S. presidential election, by offering a regulated alternative that could appeal to retail traders.

"This product would be particularly attractive for retail users due to its simplicity," said Nic Puckrin, analyst and co-founder of Coin Bureau.

"Although retail participation in derivatives markets has grown substantially over the years, a binary, all-or-nothing options product would certainly appeal to less experienced investors."

Prediction markets allow traders to wager on how real-world events will unfold, from sports results and entertainment releases to elections and economic data.

Investors increasingly view prediction markets as a growth opportunity, prompting several firms to enter the space as it gains legitimacy and opens up new revenue streams and market insights.

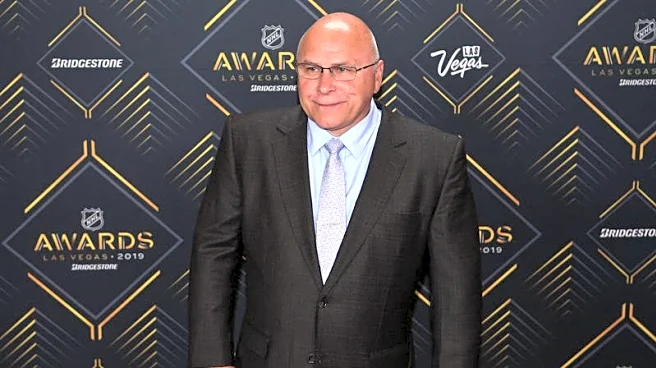

Cboe CEO Craig Donohue in October said the derivative exchange will concentrate on event and prediction, digital and crypto markets, adding that there is strong growth in these areas.

Prediction market startups Kalshi and Polymarket have expanded rapidly. In December, derivatives exchange CME Group and sports betting firm FanDuel launched their prediction markets platform in five U.S. states.

In 2008, the largest U.S. options market launched binary options on the Standard & Poor's 500 Index and the CBOE Volatility Index, showing that the exchange has long explored such contracts tied to market outcomes.

The Wall Street Journal first reported on Monday that Cboe was in discussions to launch all-or-nothing options contracts.

(Reporting by Prakhar Srivastava in Bengaluru; Editing by Alan Barona)