By Maggie Fick and Mrinalika Roy

VIENNA (Reuters) -Eli Lilly has established itself as the market leader in obesity drugs in Europe, Asia and the Middle East and expects to replicate its U.S. dominance

globally, the company's international president told Reuters on Wednesday. Patrik Jonsson said that the drugmaker is applying a consumer-focused commercial strategy similar to its U.S. approach, including partnerships with telehealth and digital platforms to reach patients who are mainly paying for weight-loss drugs out-of-pocket, from Britain to China to the United Arab Emirates.

"We learned very rapidly from the U.S. the importance of taking a very strong consumer focus," said Jonsson. Lilly is using that model in markets including Australia and China, where it has partnered with e-commerce giants Alibaba and JD.com, he said.

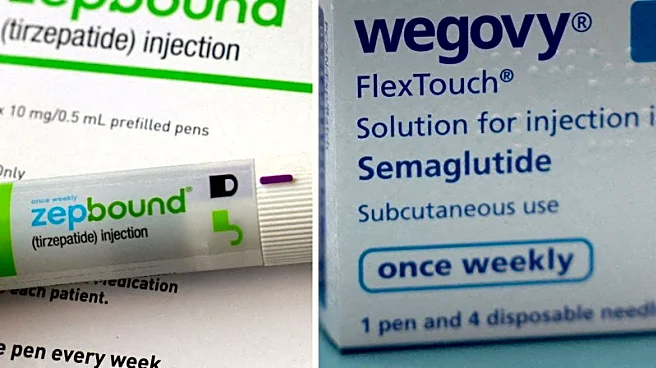

Lilly launched its weight-loss drug Mounjaro this year in Mexico, Brazil, India and China after swiftly gaining market share in Europe despite launching many months after rival Novo Nordisk introduced its Wegovy weight-loss injection. Jonsson said Lilly delayed some rollouts to ensure consistent supply, avoiding the volume-capped launches by Novo in 2023 and 2024.

"Even if many countries wanted Mounjaro earlier, we waited until the day when we believed we could have a reliable supply in place." While Lilly did begin with limited supply in a few countries, Jonsson said those caps were clearly communicated and typically lifted within months.

He said that Lilly was well-positioned to increase its supply of Mounjaro rapidly in multiple markets because it produces the medicine in several formats, including an auto-injector device and a vial format.

Novo Nordisk was first to market with a highly effective GLP-1 obesity drug in 2021, but Lilly has pulled ahead this year, with total prescriptions for Mounjaro now surpassing Novo's Wegovy. Surging global demand for weight-loss drugs has strained supply chains for both Novo and Lilly.

Lilly's shares are down about 1% year-to-date, compared to a 41% drop in Novo shares.

(Reporting by Maggie Fick and Mrinalika Roy; Editing by Ros Russell and Sharon Singleton)