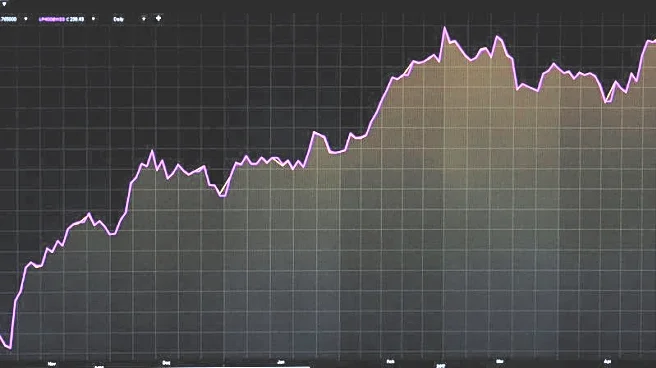

(Reuters) -Wall Street's artificial intelligence-driven rally will extend into 2026, UBS Global Research said on Monday, as the brokerage set the S&P 500 index's year-end target for next year at 7,500,

betting on strong corporate earnings and gains in a concentrated but resilient technology sector.

The benchmark index is nearing the 7,000-point mark, having closed at 6,728.80 on Friday, spurred by investor optimism around AI, robust corporate profits and expectations of falling interest rates.

Big Tech giants like Nvidia, Microsoft and Alphabet remain key drivers of the rally, with AI-linked spending fueling record capex.

"We see S&P 500 earnings growing at 14.4% through 2026. After a couple of slow quarters, growth should begin to accelerate from (the second quarter of next year)," the European brokerage said.

It said that although worries about a market bubble and the valuation of AI stocks persist, the effect is likely to be small.

GLOBAL OUTLOOK

In its note titled 'Global Economics and Markets Outlook 2026-2027,' UBS said it expects the global economy to accelerate in 2026, with business and consumer confidence improving, and major economies to roll out fresh fiscal stimulus.

"In the next 4-5 months though, we first need to navigate a soft patch, with tariffs still feeding through to prices (the U.S.) and exports (globally)," UBS cautioned.

Among emerging markets, UBS prefers Chinese equities and the yuan.

The brokerage said that improving confidence, falling real interest rates and a pickup in credit growth are creating room for emerging market central banks to ease policy further.

UBS also said the U.S. dollar and Treasury's safe-haven status loss to German bonds, gold and European axis currencies could change as inflation in the world's largest economy drops sharply in the second half of 2026.

(Reporting by Rashika Singh and Siddarth S in Bengaluru; Editing by Sahal Muhammed)