By Howard Schneider

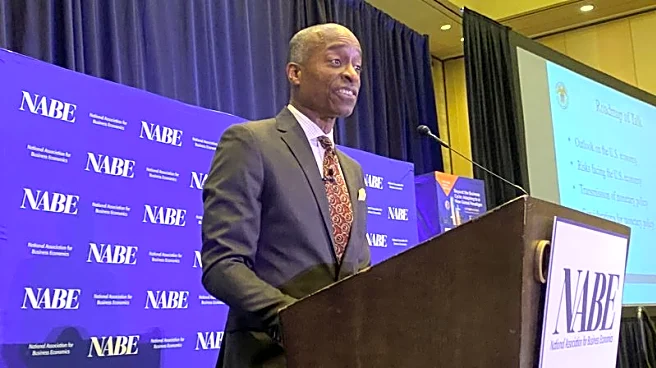

WASHINGTON (Reuters) -The Fed should "proceed slowly" in approving further interest rate cuts as monetary policy moves closer to a neutral stance, Fed Vice Chair Philip Jefferson said

on Friday.

Following a quarter-point rate cut last week, which Jefferson supported, he said "the current policy stance is still somewhat restrictive," and serving to push down inflation that available information suggests has not changed much since last year and remains above the U.S. central bank's 2% target.

But the benchmark policy rate, currently set in the 3.75% to 4% range, is now "closer to its neutral level that neither restricts nor stimulates the economy," Jefferson said in remarks prepared for delivery at Germany's Bundesbank. "Given this, it makes sense to proceed slowly as we approach the neutral rate."

He said he would make rate cut decisions "meeting by meeting," an approach he described as "especially prudent because it is unclear how much official data we will have before our December meeting," given the ongoing federal government shutdown.

The Fed meets on Dec. 9-10 with investors expecting another quarter point rate cut. At a press conference following the Fed meeting last week, however, Fed Chair Jerome Powell said that a December cut "not a forgone conclusion—far from it." Powell's remarks reflected divided opinions among policymakers over whether a weakening job market or persistently above-target inflation poses greater risk to the U.S. economy right now.

The rate cut was approved with dissents in favor of both tighter and looser monetary policy, an unusual outcome in a consensus-driven organization.

Jefferson's arguments echoed those Powell raised about how the lack of jobs, inflation and other statistics during a federal shutdown now in its second month may make the Fed more cautious about reducing rates without the usual suite of economic data in hand.

Policymakers do have information from the Fed's own surveillance of the economy, state records, and privately collected information. Jefferson said it indicates "that the overall economic picture in the U.S. has not changed much over the past few months," with the labor market "gradually cooling" and inflation "running at a rate similar to that of a year ago."

The bulk of Jefferson's comments were about the implications of artificial intelligence for the economy, and particularly for the Fed's twin goals of stable prices and maximum employment.

He said the new technology could disrupt traditional patterns of employment, a process that may already be underway, and lead to weaker inflation if productivity increases.

But with adoption still in the early stages, "the short answer is that it is likely still too soon to tell."

(Reporting by Howard Schneider in Washington; Editing by David Gregorio)