What's Happening?

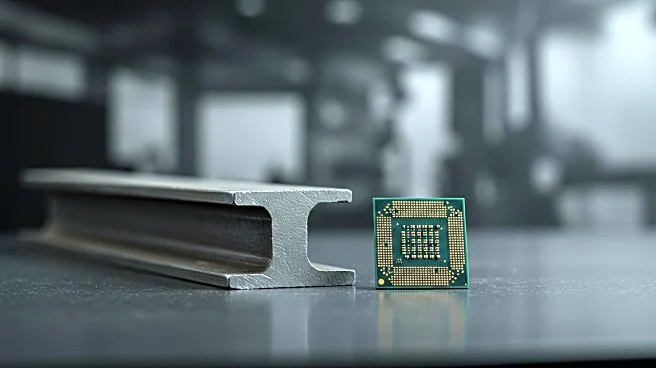

President Donald Trump has announced plans to impose tariffs on imports of steel and semiconductor chips in the coming weeks. The tariffs are part of a broader strategy to encourage domestic manufacturing. Trump stated that the initial tariff rates would be lower to allow companies time to establish manufacturing operations in the United States, with rates increasing significantly later. This approach mirrors his previous tariff strategy on pharmaceuticals. Trump has previously raised tariffs on steel and aluminum to 25% and later doubled them to 50% to support U.S. manufacturers. The semiconductor tariffs are expected to reach 100%, with exemptions for companies that commit to manufacturing in the U.S.

Why It's Important?

The imposition of tariffs on steel and semiconductor imports is significant as it aims to bolster domestic manufacturing, potentially leading to increased investment in U.S. production facilities. This move could impact global trade dynamics, as higher tariffs may discourage imports and encourage companies to relocate manufacturing operations to the United States. However, it may also lead to increased costs for industries reliant on these imports, affecting pricing and competitiveness. The strategy reflects Trump's broader economic policy of prioritizing American manufacturing and reducing dependency on foreign imports.

What's Next?

The announcement of tariffs is likely to prompt reactions from affected industries and international trade partners. Companies may need to assess the financial implications of the tariffs and consider relocating manufacturing operations to the U.S. to avoid higher costs. Trade partners may respond with their own tariffs or seek negotiations to mitigate the impact. The U.S. government may also face pressure from domestic industries to provide support or exemptions to ease the transition.