What's Happening?

Rockwell Automation has reported a 5% increase in sales for its fiscal third quarter, reaching $2.14 billion. The company plans to invest over $2 billion in its operations, primarily in the U.S., over the next five years. This investment will focus on capital improvements in plants, talent, and digital infrastructure. Rockwell's gross profit increased from $795 million to $876 million year-over-year, with net income rising from $231 million to $293 million. The company has upgraded its sales and earnings forecast for the final quarter, despite anticipating sales to range between a decline of 2% and an increase of 1%.

Why It's Important?

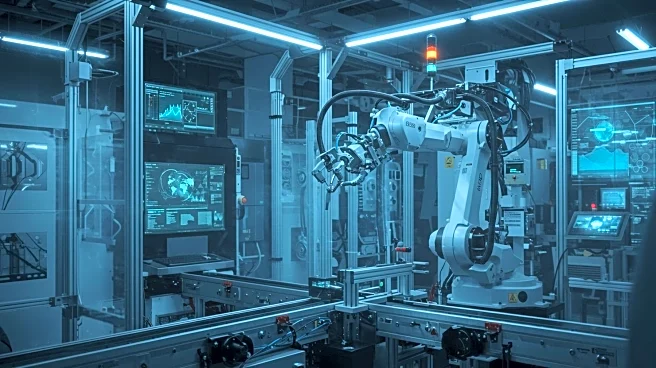

Rockwell Automation's substantial investment in U.S. operations underscores its commitment to enhancing its manufacturing capabilities and workforce. This move is significant for the industrial automation sector, as it reflects confidence in the U.S. market and the potential for growth in automation technologies. The investment is expected to drive innovation and efficiency, benefiting industries reliant on automation solutions. Rockwell's improved financial performance and strategic investments position it to capitalize on the increasing demand for automation in manufacturing, logistics, and other sectors.

What's Next?

Rockwell Automation's focus on U.S. capital investment suggests a strategic shift towards strengthening domestic operations. The company's upgraded forecast indicates optimism about future sales growth, driven by new customer wins and opportunities in brownfield and greenfield projects. As Rockwell continues to invest in digital infrastructure and talent, it is likely to enhance its competitive edge in the industrial automation market. Stakeholders will be watching for further developments in Rockwell's investment strategy and its impact on the company's long-term growth and profitability.