What's Happening?

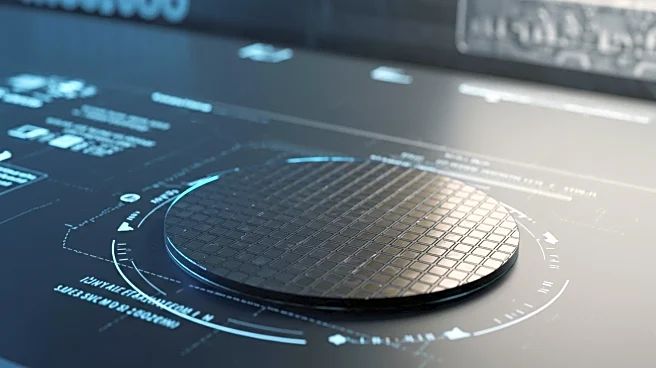

Erste Asset Management GmbH has reduced its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (NYSE:TSM) by 3.7% in the first quarter, selling 6,196 shares. Despite this reduction, Erste Asset Management still holds 159,904 shares valued at $26,492,000. Other institutional investors have also adjusted their positions, with some increasing their stakes in the semiconductor company. Analysts continue to rate TSM as a 'Buy', with a consensus price target of $258.33, reflecting confidence in the company's market performance.

Why It's Important?

The decision by Erste Asset Management to decrease its holdings in TSM may signal a strategic shift or profit-taking move. However, the continued 'Buy' rating from analysts suggests that the company remains a strong player in the semiconductor industry. TSM's performance is critical to the tech sector, influencing supply chains and innovation. The company's ability to maintain high margins and revenue growth is vital for investors and stakeholders in the tech ecosystem.

What's Next?

Taiwan Semiconductor Manufacturing's future performance will be influenced by its ability to navigate industry challenges and maintain its competitive edge. Analysts and investors will monitor the company's strategic initiatives and market conditions closely. The semiconductor industry faces potential disruptions from geopolitical tensions and supply chain issues, which could impact TSM's operations and stock performance.