What's Happening?

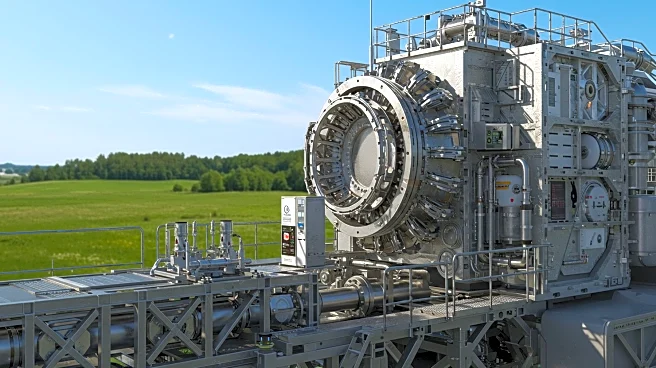

Global Infrastructure Partners (GIP), a major infrastructure investor associated with BlackRock, has finalized an agreement to acquire a 49.99% stake in Eni CCUS Holding. Eni CCUS is a prominent platform in the carbon capture, utilization, and storage (CCUS) sector, with projects in the UK, Netherlands, and potential involvement in Italy. This acquisition is part of a strategic partnership aimed at accelerating the development of CCUS projects, which are crucial for decarbonizing industrial clusters. The partnership will leverage GIP's infrastructure expertise and Eni's technical capabilities to expand CCUS solutions, addressing the growing demand for decarbonized energy.

Why It's Important?

The acquisition signifies a significant step in the global push towards decarbonization, highlighting the importance of CCUS technology in reducing industrial CO2 emissions. This partnership could potentially unlock new business opportunities and enhance the deployment of large-scale decarbonization solutions. For the U.S. and global markets, this development underscores the critical role of infrastructure investment in the energy transition, which is estimated to require over $100 trillion. Stakeholders in the energy and industrial sectors stand to benefit from the accelerated deployment of CCUS technologies, which are essential for meeting climate goals and reducing carbon footprints.

What's Next?

The partnership between GIP and Eni is expected to facilitate the expansion of CCUS projects across various geographies. As regulatory and market conditions evolve, Eni CCUS may participate in additional projects, particularly in depleted oil and gas fields. This could lead to further investments and collaborations aimed at enhancing decarbonization efforts. The strategic alliance is likely to attract more capital and interest in CCUS technologies, potentially influencing policy decisions and encouraging other companies to invest in similar initiatives.

Beyond the Headlines

The collaboration between GIP and Eni highlights the growing trend of integrating infrastructure investment with sustainable energy solutions. This move could set a precedent for other infrastructure investors to consider environmental impacts in their investment strategies. Additionally, the focus on CCUS technology reflects a broader shift towards innovative solutions for climate change mitigation, which could have long-term implications for energy policies and industrial practices worldwide.