What's Happening?

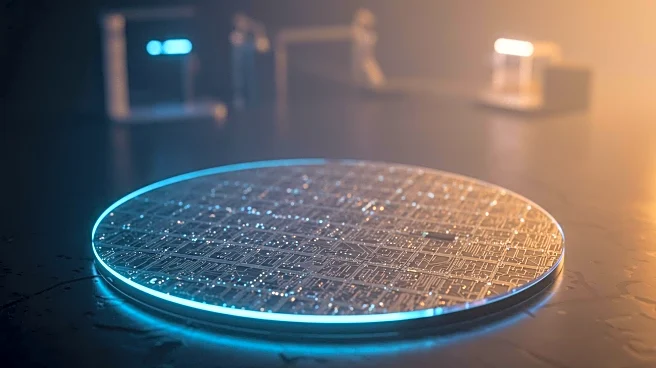

Taiwan Semiconductor Manufacturing Co. (TSMC) has announced its first profit from its Arizona manufacturing plant, marking a significant milestone since the facility began operations late last year. The company reported a net profit of $150.1 million for the first half of 2025, a notable turnaround from a net loss of $143.4 million during the same period in the previous year. This financial improvement is attributed to strong demand for AI-related products from U.S. customers, prompting TSMC to increase production at the Arizona site. The development comes as the U.S. Department of Commerce has reportedly shifted its stance on acquiring equity stakes in TSMC and Micron Technology in exchange for federal CHIPS Act subsidies. While the White House is not pursuing equity in these companies, those not expanding their U.S. investments may need to offer equity for subsidies.

Why It's Important?

The profitability of TSMC's Arizona plant underscores the growing demand for semiconductor products, particularly those related to artificial intelligence, in the U.S. market. This development is crucial for the U.S. semiconductor industry, which has been striving to increase domestic production and reduce reliance on foreign suppliers. The success of TSMC's operations in Arizona could encourage further investment in U.S.-based manufacturing facilities, potentially boosting local economies and creating jobs. Additionally, the U.S. government's approach to leveraging CHIPS Act subsidies to incentivize domestic investment highlights a strategic effort to strengthen the national semiconductor supply chain, which is vital for technological advancement and economic security.

What's Next?

As TSMC continues to ramp up production in response to AI demand, the company may further expand its operations in Arizona, potentially leading to increased employment opportunities and economic growth in the region. The U.S. Department of Commerce's evolving policy on CHIPS Act subsidies could also influence other semiconductor companies to enhance their U.S. investments to qualify for federal support. This could lead to a more robust domestic semiconductor industry, reducing vulnerabilities in the global supply chain. Stakeholders, including policymakers and industry leaders, will likely monitor these developments closely to assess their impact on the U.S. economy and technological competitiveness.