What's Happening?

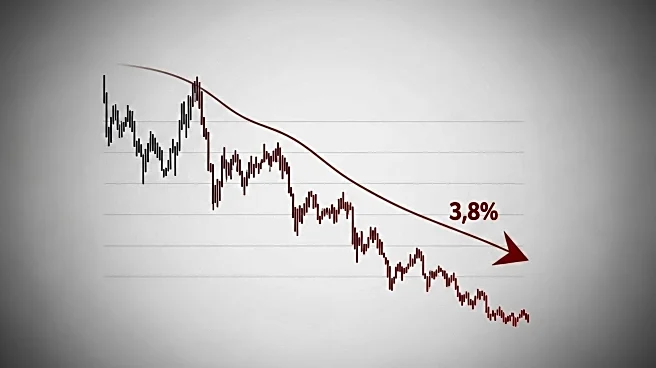

Woodward Inc. has seen its shares decline by 3.8% since its last earnings report, underperforming the S&P 500. The company reported third-quarter fiscal 2025 adjusted net earnings per share of $1.76, an 8% increase year-over-year, surpassing the Zacks Consensus Estimate by 8.6%. Net sales grew 8% year-over-year to $915 million, driven by strong performance in the Aerospace segment and Core Industrial business. Despite positive earnings, the company narrowed its free cash flow range due to increased working capital needs.

Why It's Important?

Woodward's earnings report highlights the company's strong performance in key segments, yet the decline in share price suggests investor concerns about future growth and cash flow management. The Aerospace segment's robust performance indicates potential for continued growth, but the narrowed free cash flow range reflects challenges in managing working capital amid supply chain dynamics. Investors will be watching how Woodward navigates these challenges to sustain growth and improve shareholder value.

What's Next?

Woodward's future performance will depend on its ability to manage working capital effectively and capitalize on growth opportunities in the Aerospace and Core Industrial segments. Investors will be looking for updates on the company's strategies to address supply chain challenges and enhance cash flow. The next earnings report will be crucial for assessing Woodward's progress and potential for a share price rebound.