What is the story about?

What's Happening?

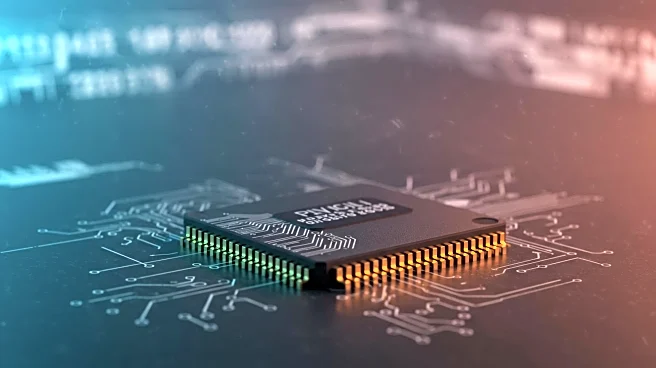

The Trump administration is reportedly considering acquiring a stake in Intel, a major American chipmaker, as part of its strategy to consolidate the U.S. chip industry. Intel is recognized for its ability to manufacture the fastest chips domestically, distinguishing it from other companies like Taiwan Semiconductor Manufacturing Company and Samsung, which, despite having U.S. factories, are foreign entities. This move aligns with broader efforts by the administration to strengthen the domestic semiconductor industry, including agreements with Nvidia and AMD to share revenue from chip sales in China and commitments from Apple to increase chip production in the U.S.

Why It's Important?

The potential acquisition of a stake in Intel by the Trump administration underscores the strategic importance of the semiconductor industry to national security and economic competitiveness. By bolstering domestic chip production, the U.S. aims to reduce reliance on foreign manufacturers and secure its technological infrastructure. This initiative could lead to increased investment in American manufacturing capabilities, potentially benefiting the economy through job creation and technological innovation. However, it also raises questions about government involvement in private industry and the implications for market competition.

What's Next?

If the Trump administration proceeds with acquiring a stake in Intel, it could prompt further government interventions in the tech sector, potentially influencing corporate strategies and international trade relations. Stakeholders, including industry leaders and policymakers, will likely debate the merits and risks of such involvement. Additionally, this move may lead to increased scrutiny from international partners concerned about the U.S.'s growing influence in the global semiconductor market.

Beyond the Headlines

The blending of business and politics in the semiconductor industry could have long-term implications for corporate governance and international relations. Ethical considerations regarding government ownership in private enterprises may arise, challenging traditional market dynamics and prompting discussions on the balance between national interests and free-market principles.