What's Happening?

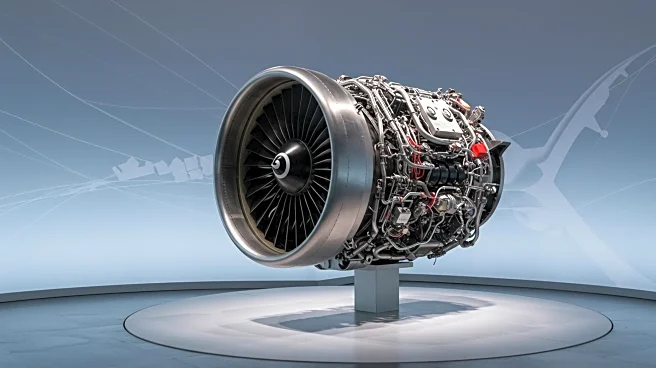

Hanwha Aviation, a South Korean engine lessor, has secured financing from KEB Hana Bank to support its growth plans in the engine leasing market. The financing deal includes a senior syndicated debt facility aimed at investing in CFM56, CFM Leap, and IAE V2500 engines. Hanwha Aviation's portfolio currently consists of around 40 engines, primarily CFM56, with plans to expand to several hundred engines over the next five years. The ultimate goal is to reach 1,000 engines to achieve necessary market scale. The financing will also support Hanwha's vertically integrated asset management strategy, which includes acquiring a U.S. engine MRO facility to enhance in-house capabilities.

Why It's Important?

The financing deal is crucial for Hanwha Aviation as it aims to become a significant player in the engine leasing market. By expanding its portfolio and integrating asset management strategies, Hanwha can offer comprehensive solutions throughout the engine lifecycle, enhancing customer value. The acquisition of a U.S. engine MRO facility strengthens Hanwha's position by providing in-house maintenance, repair, and overhaul capabilities. This move complements Hanwha's existing strengths in aerospace manufacturing and partnerships with major engine OEMs like General Electric, Pratt & Whitney, and Rolls-Royce.

What's Next?

Hanwha Aviation plans to continue expanding its engine portfolio and integrating its asset management strategy. The acquisition of the U.S. engine MRO facility is a foundational step in this approach, allowing Hanwha to offer cost-effective solutions and enhance its market presence. The company aims to leverage its partnerships and expertise to achieve its goal of 1,000 engines, positioning itself as a leader in the engine leasing market.