What's Happening?

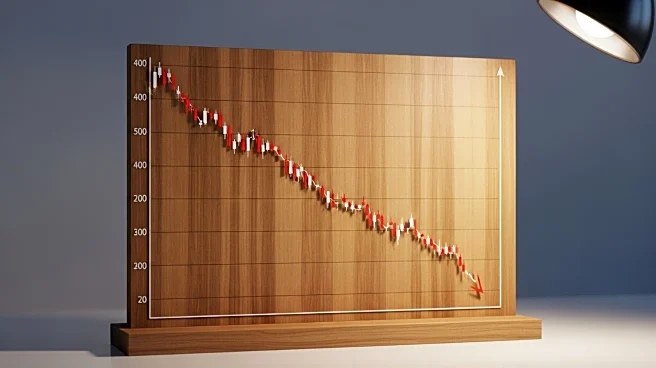

American Woodmark, a cabinet manufacturing company, experienced a 3.6% drop in its stock price during pre-market trading following the release of its second-quarter financial results. The company reported net sales of $403 million, marking a 12.2% decrease compared to the same quarter last year. This figure fell short of analyst expectations, as did the adjusted earnings per share, which came in at $1.01, a significant drop from the $1.89 reported in the previous year. The decline in sales and profitability was attributed to increased competition and rising input and operating costs. Additionally, the company's gross margin fell by 3.5 percentage points, and its operating margin dropped by 5.2 percentage points year-on-year. American Woodmark did not update its financial guidance due to a proposed merger with MasterBrand.

Why It's Important?

The financial performance of American Woodmark highlights the challenges faced by manufacturers in a competitive market with rising costs. The decline in revenue and earnings could impact investor confidence and the company's market valuation. The broader implications include potential pressure on the manufacturing sector, especially in light of rising wholesale inflation, which complicates the Federal Reserve's interest rate decisions. Persistent inflation may hinder rate cuts, affecting cyclical sectors like Industrials. The company's stock has already seen a 14.5% decline since the beginning of the year, reflecting investor concerns about profitability and market conditions.

What's Next?

American Woodmark's future financial performance may be influenced by the proposed merger with MasterBrand, which could offer strategic advantages or further challenges. Investors and analysts will likely monitor the company's ability to navigate cost pressures and competitive dynamics. The Federal Reserve's upcoming decisions on interest rates, influenced by inflation data, will also be crucial for the manufacturing sector. Stakeholders may anticipate further volatility in American Woodmark's stock price as the market reacts to these developments.

Beyond the Headlines

The situation with American Woodmark underscores the broader economic challenges faced by manufacturers, including tariff impacts and inflationary pressures. These factors may lead to strategic shifts within the industry, such as mergers and acquisitions, to enhance competitiveness and operational efficiency. The company's experience may serve as a case study for other manufacturers dealing with similar issues.