What's Happening?

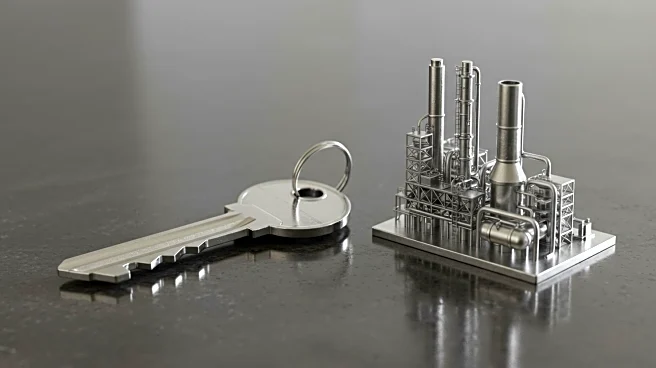

Tianqi Lithium, a Chinese company, has expressed openness to renegotiating its joint venture partner IGO's stake in the Kwinana lithium refinery located in Western Australia. The refinery, which is the first lithium hydroxide plant in Australia, has faced operational challenges and production delays amid a slump in lithium prices. IGO, holding a 49% stake, has written down the refinery as loss-making and expressed low confidence in its improvement. Tianqi's CEO, Frank Ha, stated willingness to discuss proposals from IGO, although no official proposals have been received yet.

Why It's Important?

The potential renegotiation of stakes in the Kwinana refinery is crucial as it could impact the future of lithium production in Australia, a key player in the global lithium market. The operational issues at the refinery highlight the challenges faced by the industry amid fluctuating commodity prices. A successful renegotiation could stabilize the refinery's operations and improve its efficiency, benefiting both companies and the broader lithium market. This situation also reflects the complexities of international partnerships in the resource sector.

What's Next?

Tianqi and IGO may engage in further discussions to reach a mutually beneficial agreement regarding the Kwinana refinery. The outcome of these negotiations could influence the strategic direction of both companies and their investments in lithium production. Industry observers and stakeholders will likely watch for any developments that could affect market dynamics and investment opportunities in the lithium sector.

Beyond the Headlines

The situation at the Kwinana refinery highlights the importance of strategic partnerships and the challenges of managing joint ventures in the resource industry. It raises questions about the sustainability of lithium production and the need for innovation to overcome operational hurdles. The potential renegotiation could also set a precedent for how companies navigate partnerships amid market volatility.