What's Happening?

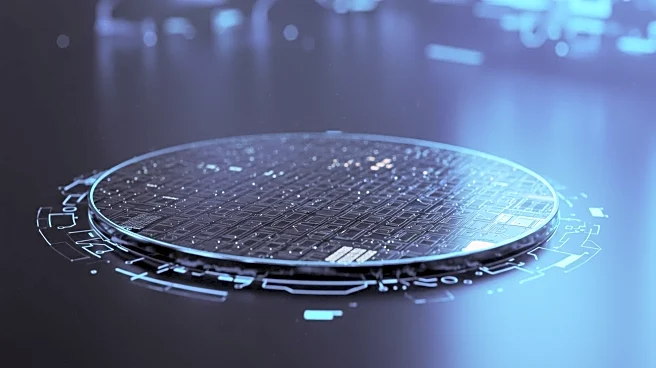

The United States government has acquired a 10% stake in Intel, investing $8.9 billion as part of its strategy to enhance domestic semiconductor manufacturing. This move is aligned with the objectives of the CHIPS Act, which aims to secure technological advancements and maintain competitiveness in the semiconductor sector. The investment follows similar commitments by other entities, such as SoftBank, which has invested $2 billion in Intel. The government's equity stake is seen as a vote of confidence in Intel's role in advancing national priorities, particularly in the context of the global semiconductor supply chain challenges.

Why It's Important?

The acquisition of a stake in Intel by the U.S. government is significant as it underscores the strategic importance of the semiconductor industry to national security and economic stability. By investing in Intel, the government aims to reduce dependency on foreign semiconductor manufacturing, which has been a critical issue amid global supply chain disruptions. This move could potentially lead to increased domestic production capabilities, fostering innovation and job creation within the U.S. technology sector. However, it also raises questions about the role of government in private enterprise and the implications of state capitalism in a traditionally market-driven industry.

What's Next?

The next steps involve monitoring the impact of this investment on Intel's operations and the broader semiconductor industry. Stakeholders, including policymakers and industry leaders, will likely assess the effectiveness of this strategy in achieving the goals of the CHIPS Act. Additionally, there may be further discussions on the balance between government intervention and market forces in the tech sector. The outcome of this investment could influence future government policies regarding strategic industries.

Beyond the Headlines

This development highlights the ongoing debate over state capitalism versus privatization in the U.S. economy. The government's involvement in Intel could set a precedent for similar investments in other critical industries. It also raises ethical and economic questions about the influence of government in corporate governance and the potential for 'nepotech,' where government relationships with large tech companies could impact market dynamics.