What's Happening?

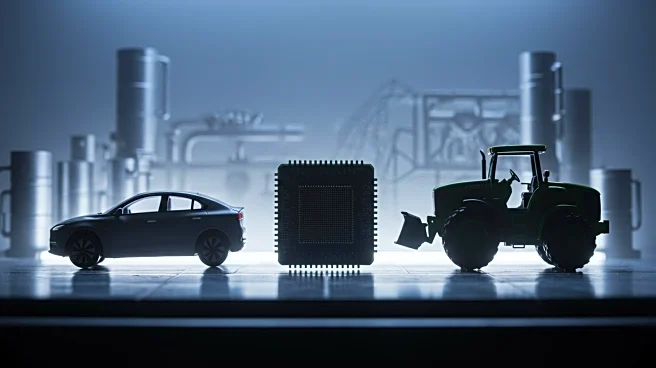

Several industrial stocks, including Tesla, Broadcom, and Deere & Company, are currently under scrutiny by investors due to their significant trading volumes and economic implications. Tesla, known for its electric vehicles and energy solutions, saw its stock price decrease slightly, trading at $333.17 with a market cap of $1.07 trillion. Broadcom, a semiconductor company, experienced a slight increase in its stock price, trading at $311.56, while Deere & Company, a major player in agricultural and construction equipment, saw a notable drop in its stock price to $478.12. These companies are part of a broader industrial sector that includes machinery, equipment, and infrastructure components, serving as indicators of economic health due to their close ties to economic activity.

Why It's Important?

The performance of these industrial stocks is crucial as they often reflect broader economic trends. Tesla's involvement in the automotive and energy sectors positions it as a key player in the transition to sustainable energy, impacting both environmental policies and market dynamics. Broadcom's role in semiconductor solutions is vital for technological advancements and infrastructure development, influencing tech industry growth. Deere & Company's fluctuations highlight the agricultural and construction sectors' sensitivity to economic cycles, affecting employment and investment in these areas. Investors and policymakers closely monitor these stocks to gauge economic stability and potential growth opportunities.

What's Next?

Investors are likely to continue monitoring these stocks for further developments, especially as economic conditions evolve. Tesla's focus on expanding its electric vehicle market and energy solutions could lead to increased demand and potential stock recovery. Broadcom's advancements in semiconductor technology may drive further growth in tech infrastructure, while Deere & Company's performance will depend on agricultural and construction sector trends. Stakeholders, including investors and industry leaders, will watch for policy changes and market shifts that could impact these companies' trajectories.