What's Happening?

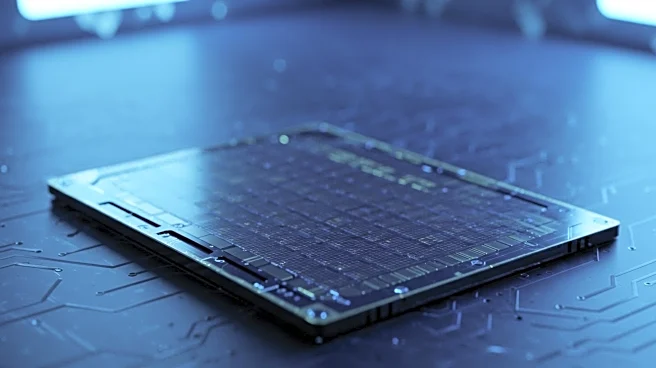

The United States government has acquired a 10% stake in Intel, a leading semiconductor company, as part of a strategic move to enhance domestic technology and semiconductor manufacturing. Announced by President Trump, this acquisition is valued at approximately $8.9 billion and represents a significant federal intervention in the private sector. The decision aligns with the CHIPS Act, which previously allocated grants to Intel for building chip plants in the U.S. These grants have now been converted into an equity stake. This move comes amid Intel's restructuring under CEO Lip-Bu Tan, focusing on core business areas to compete with rivals like Nvidia. The acquisition follows a similar investment by SoftBank, which committed $2 billion to Intel.

Why It's Important?

The U.S. government's acquisition of a stake in Intel is a landmark move aimed at strengthening the country's semiconductor industry, which is vital for national security and technological leadership. This investment underlines the strategic importance of semiconductors in the global tech landscape and the need for the U.S. to secure its supply chains. By supporting Intel, the government aims to bolster domestic production capabilities, reduce reliance on foreign manufacturers, and enhance competitiveness against global rivals. This could lead to increased innovation, job creation, and economic growth within the U.S. tech sector.

What's Next?

The acquisition is expected to accelerate Intel's restructuring efforts and its focus on core business areas. The U.S. government may continue to support similar initiatives to strengthen domestic semiconductor manufacturing. Stakeholders, including industry leaders and policymakers, will likely monitor the impact of this investment on Intel's market performance and the broader semiconductor industry. Future policy decisions may further incentivize domestic production and innovation in the tech sector.