What's Happening?

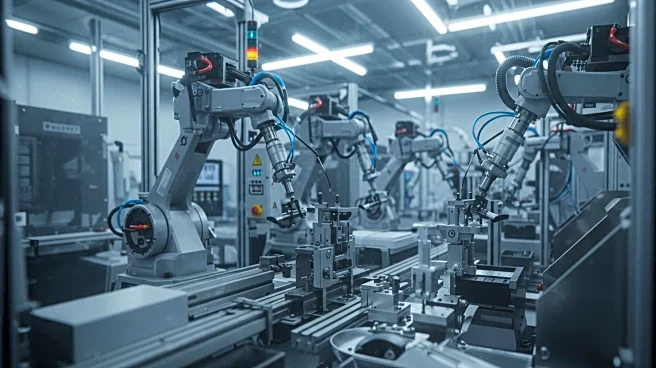

Retractable Technologies is navigating the challenges posed by U.S.-China tariffs and the need to increase domestic production. In Q2 2025, the company reported a 73.3% year-over-year increase in net sales, driven by demand for its EasyPoint® needles. However, tariffs have significantly impacted costs, with expenses reaching $561,000 in Q2 alone. To mitigate these pressures, Retractable has shifted 38% of its production to the U.S., investing $1.6 million in equipment upgrades and increasing domestic manufacturing staff by 40%. Despite these efforts, the company faces ongoing margin pressures and operational losses.

Why It's Important?

Retractable Technologies' strategic shift to domestic production aligns with broader U.S. policy trends favoring onshoring. This move could reduce reliance on Chinese imports and stabilize average selling prices, potentially unlocking value for shareholders. However, the company must overcome significant challenges, including tariff costs and competitive pressures from larger players. The success of its domestic production strategy could have implications for the U.S. manufacturing sector and influence future policy decisions regarding tariffs and trade.

What's Next?

Retractable Technologies aims to achieve cost parity with overseas manufacturing within 18-24 months. The company plans to optimize operations to reduce per-unit costs and secure further tariff relief through policy advocacy. Investors will be closely monitoring key metrics, including domestic production costs and revenue diversification, to assess the company's long-term viability.

Beyond the Headlines

The shift to domestic production raises questions about workforce dynamics and the potential impact on local economies. As Retractable Technologies increases its U.S. manufacturing capabilities, it may contribute to job creation and economic growth in the regions where it operates.