What's Happening?

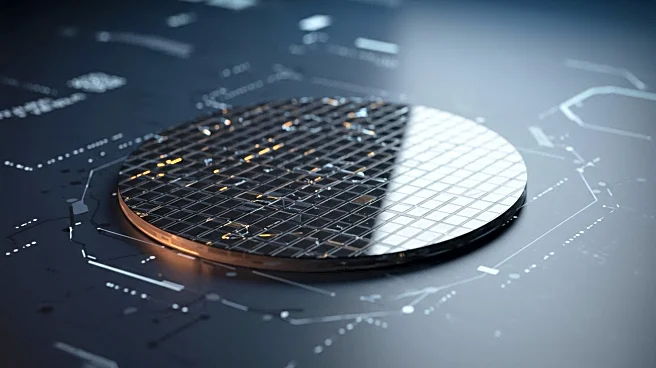

The U.S. government has announced a significant investment in the semiconductor industry by acquiring a 10% stake in Intel, valued at $8.9 billion. This move is part of a broader strategy to enhance U.S. leadership in key technological sectors, particularly in semiconductors. The investment is funded through grants previously awarded under the CHIPS and Science Act, which was enacted during President Joe Biden's administration. The Act aims to reshore chip manufacturing in the United States, a sector deemed critical for economic and national security. President Trump highlighted the importance of this deal, emphasizing its role in securing America's technological edge. Intel, a leading semiconductor company, has faced challenges in recent years, lagging behind competitors like Nvidia in market capitalization and technological advancements.

Why It's Important?

This investment underscores the U.S. government's commitment to strengthening its semiconductor industry, which is vital for maintaining technological supremacy and economic stability. By acquiring a stake in Intel, the government aims to ensure that advanced technologies are developed domestically, reducing reliance on foreign manufacturing. This move could potentially revitalize Intel's position in the global market, providing it with the necessary resources to compete with industry leaders like Nvidia. The decision also reflects broader geopolitical considerations, as the U.S. seeks to mitigate risks associated with foreign dependencies, particularly in light of tensions with China. Stakeholders in the semiconductor industry, including manufacturers and technology firms, stand to benefit from increased government support and investment.

What's Next?

The acquisition is expected to prompt further developments in the semiconductor sector, with potential implications for U.S. manufacturing policies and international trade relations. Intel may leverage this investment to expand its research and development capabilities, focusing on cutting-edge technologies such as artificial intelligence and mobile technology. The U.S. government may continue to explore similar investments in other key industries to bolster domestic production and innovation. Additionally, this move could influence other countries to adopt similar strategies, potentially reshaping the global semiconductor landscape.

Beyond the Headlines

The investment raises questions about the ethical and legal dimensions of government involvement in private enterprises. It also highlights the cultural shift towards prioritizing national security in economic decisions. The focus on reshoring manufacturing aligns with broader trends of economic nationalism and protectionism, which could have long-term implications for global trade dynamics. Furthermore, the scrutiny of Intel's leadership and its ties to China reflects ongoing concerns about corporate governance and international relations.