What is the story about?

What's Happening?

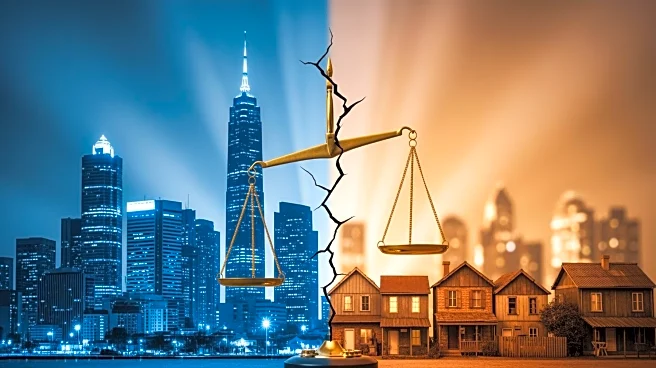

A growing number of homeowners are choosing to delist their properties rather than lower their asking prices, according to Realtor.com's July 2025 Monthly Housing Market Trends Report. The report indicates that delistings have increased by 38% since the start of the year and 48% from June 2024. This trend is largely driven by homeowners who purchased properties in pandemic boomtowns like Austin, Texas, and Cape Coral, Florida, where they now face underwater mortgages. An underwater mortgage occurs when the principal of a home loan exceeds the market value of the property. As a result, homeowners are in a difficult position, as selling their homes would require them to pay the remaining balance to their mortgage company if the sale price is lower than the mortgage amount. Some homeowners are opting to wait out the market due to favorable mortgage rates, hoping for better offers in the future.

Why It's Important?

The increase in delistings highlights a significant shift in the real estate market, particularly in areas that experienced rapid growth during the COVID-19 pandemic. This situation poses challenges for both homeowners and the broader housing market. Homeowners with underwater mortgages may face financial strain, as they are unable to sell their properties without incurring losses. This could lead to decreased mobility and financial flexibility for affected individuals. Additionally, the trend may impact the housing market by reducing the supply of available homes, potentially driving up prices for buyers who are still active in the market. The situation underscores the volatility and unpredictability of real estate markets, especially in regions that experienced pandemic-driven booms.

What's Next?

Homeowners and real estate professionals will likely monitor market conditions closely, hoping for stabilization or improvement in property values. If mortgage rates remain favorable, some homeowners may continue to hold onto their properties, waiting for better market conditions. Real estate analysts and economists will be watching for signs of recovery or further decline in these boomtowns, which could influence broader market trends. Policymakers may also consider interventions to support homeowners facing financial difficulties due to underwater mortgages, potentially through refinancing options or other financial assistance programs.

Beyond the Headlines

The trend of delisting properties rather than lowering prices may reflect broader economic and cultural shifts. Homeowners' reluctance to sell at a loss could indicate changing attitudes towards property ownership and financial risk. Additionally, the situation may prompt discussions about the sustainability of rapid real estate growth and the need for more balanced development strategies in high-demand areas. The long-term implications could include shifts in population dynamics, as individuals reconsider living in areas with volatile property markets.