What's Happening?

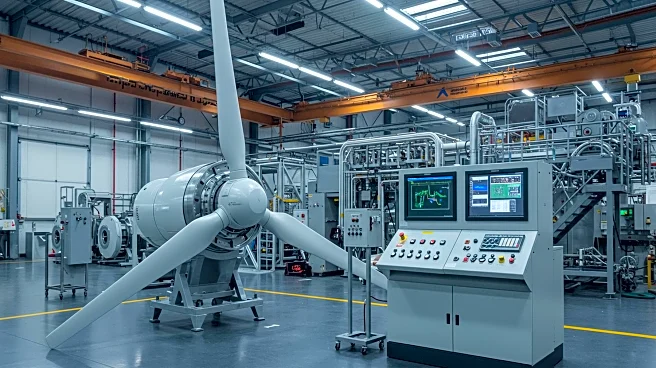

Broadwind Energy is navigating the challenges and opportunities presented by the global shift towards decarbonization. In Q2 2025, the company reported mixed financial results, with $39.2 million in revenue and a $1 million net loss. This reflects the tension between its traditional industrial exposure and the potential for growth in clean energy. Broadwind is strategically realigning its operations, focusing on precision manufacturing and asset rationalization. The company is divesting non-core assets, such as its Manitowoc, Wisconsin operations, to reduce costs and redirect capital towards wind infrastructure, which is expected to grow significantly. The Heavy Fabrications segment, specializing in wind tower sections, saw a 27.4% increase in revenue, highlighting the company's shift towards renewable energy.

Why It's Important?

Broadwind Energy's strategic pivot is significant as it aligns with major forces in the energy market, including the U.S. Inflation Reduction Act and the global push for wind turbine repowering. The company's focus on precision manufacturing positions it to capitalize on the demand for transitional gas power and renewable energy integration. With a 100% U.S.-based production footprint, Broadwind is well-placed to benefit from domestic clean energy manufacturing incentives and the Biden administration's emphasis on reshoring. The global wind repowering market is expected to grow, providing Broadwind with opportunities to leverage its expertise in precision-engineered repowering adapters.

What's Next?

Broadwind faces challenges such as rising overhead costs and competition from foreign manufacturers, which could impact margins. However, the pending divestiture of its Manitowoc operations is expected to improve liquidity and reduce leverage, providing a path to operational discipline. Analysts project that the company's adjusted EBITDA margin could expand as it scales wind production and realizes cost synergies. The company's strategic focus on precision manufacturing and clean energy infrastructure offers a compelling risk-reward profile for long-term investors.

Beyond the Headlines

Broadwind Energy's transformation reflects the broader industrial sector's struggle to adapt to the energy transition. While the company's Q2 results highlight the challenges of this transformation, they also reveal a proactive approach to reshaping its business for future growth. The company's lean operations and growing order backlog mitigate concerns about policy uncertainty and execution challenges. Broadwind's strategic turnaround offers a unique opportunity for investors seeking undervalued plays in precision manufacturing and clean energy.