What's Happening?

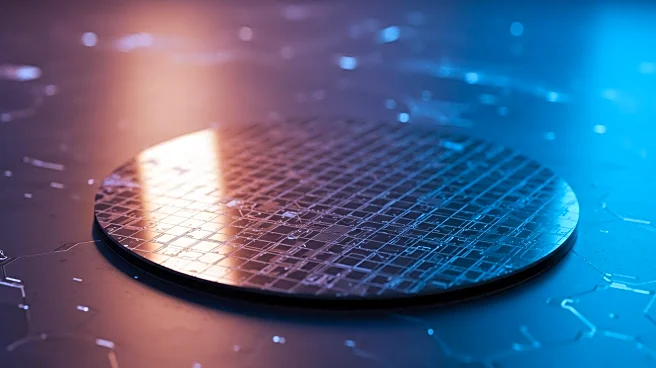

Japanese conglomerate SoftBank has announced a $2 billion investment in Intel, marking a significant commitment to the advancement of technology and semiconductors in the United States. The investment involves SoftBank purchasing Intel common stock at $23 per share, slightly below the closing price of $23.66, which led to a 5% increase in Intel's after-hours trading. SoftBank Group Chairman and CEO Masayoshi Son emphasized the strategic importance of this investment, highlighting Intel's critical role in expanding semiconductor manufacturing and supply in the U.S. This move comes as Intel undergoes restructuring under new CEO Lip-Bu Tan, focusing on its core client and data center portfolio while reducing its workforce in other divisions.

Why It's Important?

The investment by SoftBank is a significant endorsement for Intel, which has faced challenges from competitors like Nvidia. It underscores the importance of semiconductor manufacturing in the U.S., especially as the Trump administration considers tariffs on imported chips to boost domestic production. This deal could enhance Intel's position in the AI chip market, a sector where SoftBank has shown renewed interest, evidenced by its recent acquisition of a factory in Ohio for AI data centers. The investment may also influence U.S. policy and industry dynamics, potentially leading to increased domestic production and innovation in semiconductor technology.

What's Next?

Intel's restructuring efforts, coupled with SoftBank's investment, may lead to further developments in the semiconductor industry. The Trump administration's stance on tariffs could impact Intel's strategy and operations, possibly encouraging more domestic production. Additionally, SoftBank's involvement might attract other international investments in U.S. technology sectors, fostering growth and competition. Stakeholders, including political leaders and industry players, will likely monitor these developments closely, assessing their implications for U.S. technological advancement and economic policy.

Beyond the Headlines

The SoftBank-Intel deal highlights broader geopolitical and economic considerations, such as the U.S.'s strategic positioning in global technology markets. It raises questions about the balance between foreign investment and domestic production, especially in critical sectors like semiconductors. The deal may also influence future collaborations between U.S. and international tech companies, potentially reshaping industry standards and practices.