What's Happening?

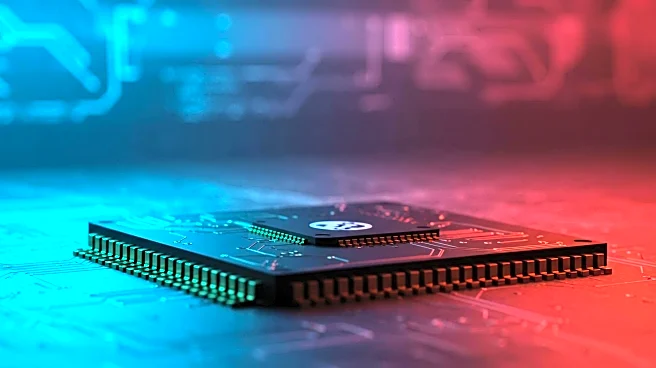

The U.S. government has acquired a 10% stake in Intel, investing $8.9 billion in the company. This move was announced by President Trump, who described the deal as a historic agreement negotiated with Intel's CEO, Lip-Bu Tan. The investment aims to bolster American leadership in semiconductor technology and manufacturing. This development follows previous tensions, as President Trump had earlier called for Tan's resignation due to alleged conflicts of interest. The investment is seen as a strategic move to enhance the U.S.'s position in the global semiconductor industry, which has been facing challenges due to supply chain disruptions and increased competition.

Why It's Important?

This investment is significant as it represents a major step by the U.S. government to secure its technological edge in the semiconductor industry, a critical sector for national security and economic growth. By acquiring a stake in Intel, the government aims to ensure that advanced silicon technologies and computing products are developed and manufactured domestically. This move could potentially lead to increased job creation and innovation within the U.S. technology sector. It also reflects a broader strategy to reduce reliance on foreign semiconductor manufacturing, which has been a concern amid geopolitical tensions and supply chain vulnerabilities.

What's Next?

Following this investment, Intel is expected to ramp up its efforts in developing cutting-edge semiconductor technologies within the U.S. The company will likely focus on expanding its manufacturing capabilities and research and development initiatives. The U.S. government may continue to explore similar investments in other technology companies to further strengthen its domestic tech industry. Stakeholders, including policymakers and industry leaders, will be closely monitoring the impact of this investment on the U.S. semiconductor market and its global competitiveness.

Beyond the Headlines

This development raises questions about the role of government in private sector investments and the potential implications for corporate governance and independence. The acquisition of a significant stake by the government could influence Intel's strategic decisions and priorities. Additionally, this move may prompt discussions about the balance between national security interests and free market principles, as well as the ethical considerations of government intervention in private enterprises.