Parliament is set to take up 13 key bills in the winter session that began on Monday.

Parliament is set to have 15 sittings in the session that will continue till December 19. While Private Members’ Bills are set to be taken for consideration on December 5 and 19, and Private Members’ resolutions on December 12.

The financial business will include presentation, discussion and voting on the first batch of supplementary demands for Grants for the year 2025-26 and introduction, consideration and passing/return of the related Appropriation Bill.

A look at the bills proposed to be taken up by the government: 1. Jan Vishwas (Amendment of Provisions) Bill, 2025: This Bill aims to continue the reform started by the 2023 version of the Jan Vishwas Act,

further decriminalising or rationalising minor offences and simplifying regulatory compliance across many sectors. Under the 2025 Bill, 355 provisions across roughly 16 Central Acts are proposed for amendment: 288 provisions to be decriminalised (i.e. replacing criminal penalties with civil/administrative penalties), and 67 provisions amended to ease “ease of living” or compliance burdens. Key changes include first-time offenders under 76 listed offences may receive warnings or improvement notices; many existing jail/fine penalties for technical or procedural defaults would be replaced with monetary penalties or warnings; and fines/penalties would automatically increase by 10% every three years to maintain deterrence without frequent legislative amendments. The Bill is pitched as part of a broader move towards “trust-based governance”, shifting from punitive criminal law for minor violations to proportionate administrative enforcement, thereby reducing burden on courts and improving ease of doing business.

ALSO READ | Parliament Winter Session Live Updates Here

2. Insolvency and Bankruptcy Code (Amendment) Bill, 2025: This Bill proposes significant amendments to the existing Insolvency and Bankruptcy Code, 2016 (IBC) to address recurring issues in insolvency resolution processes. It includes introduction of a new “Creditor-Initiated Insolvency Resolution Process” (CIIRP) — allowing certain financial creditors to start insolvency proceedings through an out-of-court mechanism, instead of immediately going to tribunal court. The Bill is presented as the biggest overhaul to the insolvency framework since IBC’s inception — aiming for faster resolution, better value preservation, greater predictability and alignment with global best practices.

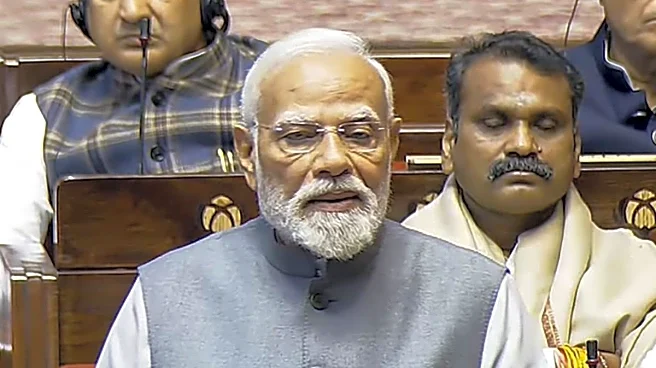

#ParliamentWinterSession | Delhi: PM Narendra Modi says, "This winter session isn't just a ritual…India has lived democracy. The zeal and enthusiasm of democracy have been expressed time and again in such a way that faith in democracy continues to grow stronger." pic.twitter.com/ihgkzQCoHu

— ANI (@ANI) December 1, 2025

3. Manipur Goods and Services Tax (Second Amendment) Bill, 2025: This Bill replaces the earlier 2025 Ordinance that amended the Manipur Goods and Services Tax Act, 2017 — needed because state legislature is under Presidential rule, and Parliament must formalise the changes. The Bill aligns Manipur’s GST law with amendments made to the central GST law (through the 2025 Finance Act). It provides a framework for determining liabilities related to tax not paid, short-paid, incorrect refunds, or wrongful use of input tax credit (ITC) for financial years 2024–25 onwards; officers must issue notices within 42 months of due dates or refund date. The Bill reduces the “pre-deposit” requirement for filing appeals (against tax demands) from 20% of disputed tax to 10%, and lowers the maximum caps (from ₹25 crore and ₹50 crore to ₹20 crore) for appeals before the Appellate Authority or Tribunal. It also revises timelines for appeals — giving the state governmentdiscretion to extend the filing period beyond the previous three months, to a later date as notified.

4. The Central Excise (Amendment) Bill, 2025: The Central Excise Amendment Bill, 2025, will replace the GST compensation Cess, which is currently levied on all tobacco products like cigarette, chewing tobacco, cigars, hookahs, zarda, and scented tobacco. The Central Excise (Amendment) Bill, 2025, seeks “to give the government the fiscal space to increase the rate of central excise duty on tobacco and tobacco products so as to protect tax incidence,” once the GST compensation Cess ends, according to the statement of objects and reasons of the Bill.

5. The Health Security se National Security Cess Bill, 2025: The Health Security se National Security Cess Bill, 2025, seeks to levy Cess on the production of specified goods like pan masala. The Government may notify any other goods on whose manufacturing such a Cess can be levied. Sin goods like tobacco and pan masala currently attract a GST of 28 per cent, plus a compensation Cess which is levied at varied rates. Once the compensation Cess ends, sale of tobacco and related products will attract GST plus excise duty, while pan masala will attract GST plus the Health Security se National Security Cess. Since the GST rate of 28 per cent has been done away with, such sin goods will be subject to the highest GST slab of 40 per cent.

6. Repealing and Amending Bill, 2025: This Bill is meant to repeal and amend a batch of outdated or redundant laws — part of the government’s ongoing legislative clean-up to remove archaic statutes, reduce legal clutter and streamline regulatory framework.

#BreakingNews | All-Party Meet Held Ahead of Parliament Winter Session; 14 Bills on Agenda@payalmehta100 brings latest bytes from @tiruchisiva @SanjayJhaBihar @JohnBrittas@Arunima24 shares more details#IndianPolitics #BJP #Congress #KirenRijiju | @DhantaNews pic.twitter.com/sRjWoNajK8

— News18 (@CNNnews18) November 30, 2025

7. National Highways (Amendment) Bill, 2025: This Bill is listed among the key bills for the Winter Session. Its purpose is to ensure faster and more transparent land acquisition for national highways projects.

8. Atomic Energy Bill, 2025: This Bill is among the 13 bills listed for the session. The broad aim of the Bill’s is to update/regulate the nuclear energy sector.

9. Corporate Laws (Amendment) Bill, 2025: This Bill aims to amend key corporate legislation (notably the Companies Act, 2013 and the Limited Liability Partnership Act, 2008), to further ease doing business and modernise corporate regulation.

10. Securities Markets Code Bill, 2025 (SMC): The SMC seeks to consolidate three existing central lawsgoverning securities markets — Securities and Exchange Board of India Act, 1992 (SEBI Act), Depositories Act, 1996, and Securities Contracts (Regulation) Act, 1956 — into a single, unified “Securities Markets Code.” The goal is to rationalise and streamline regulation of capital markets, presumably simplifying compliance, reducing overlap/duplication among laws, and making the regulatory architecture more coherent.

11. Insurance Laws (Amendment) Bill, 2025: This Bill is intended to modernise and accelerate growth of the insurance sector in India.

12. Arbitration and Conciliation (Amendment) Bill, 2025: This Bill seeks to amend the Arbitration and Conciliation Act, 1996 — the principal law governing arbitration in India.

13. Higher Education Commission of India Bill, 2025: This Bill is listed among the 13-bill agenda for the Winter Session.

With Agency Inputs

/images/ppid_59c68470-image-177100753350744656.webp)

/images/ppid_a911dc6a-image-17710070301901476.webp)

/images/ppid_a911dc6a-image-177100572282276854.webp)