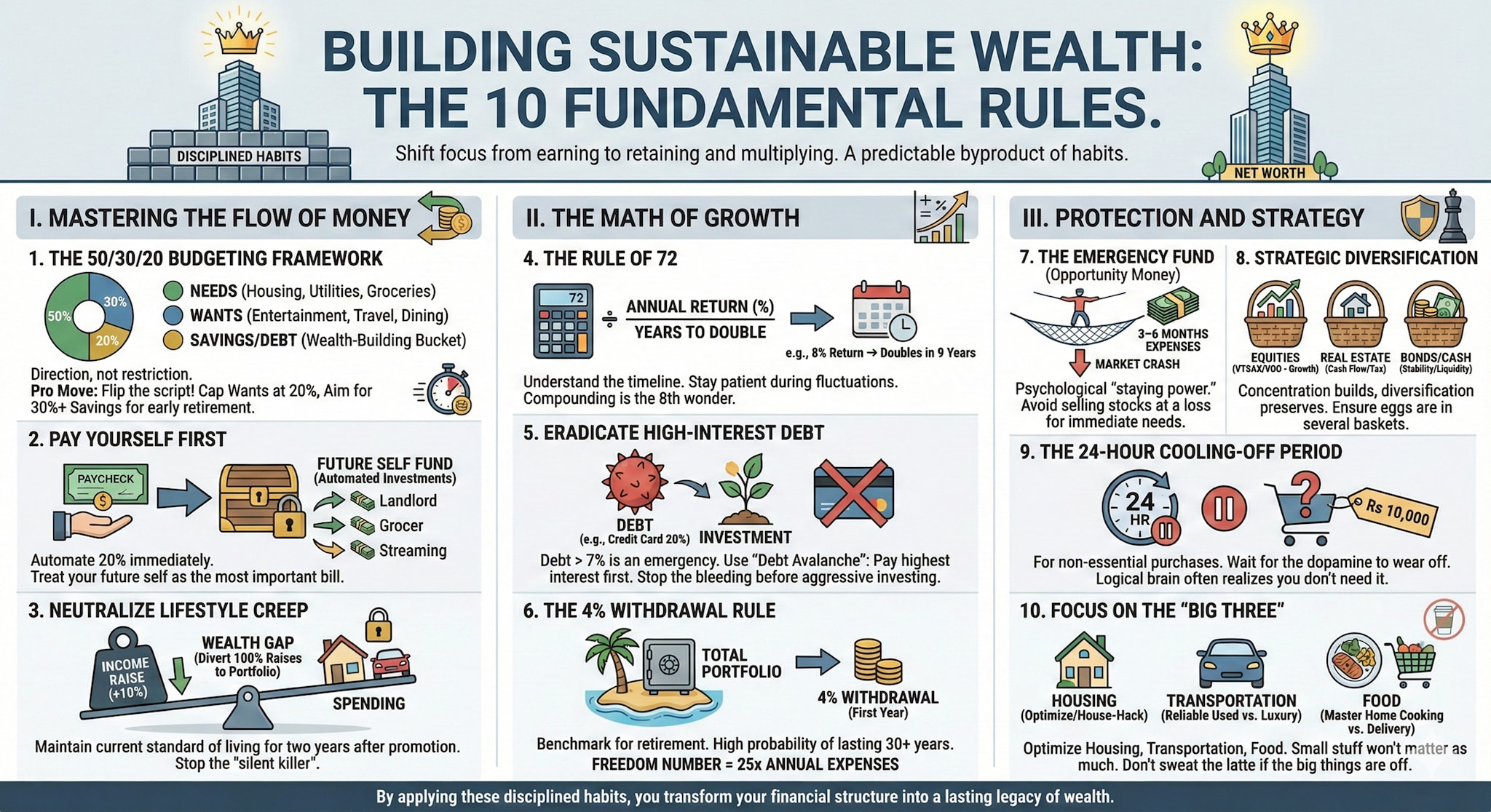

Achieving financial independence has become a central point in every personal finance discussion. Saving sufficient money to cover the expenses for the rest of your life gives mental peace and stability. However, it requires a rigorous discipline. To build a net worth that lasts, you must shift your focus from earning to retaining and multiplying. Here are the ten fundamental rules to help you scale your wealth.

I. Mastering the Flow of Money

1. The 50/30/20 Budgeting Framework

Budgeting isn’t about restriction; it’s about direction. The 50/30/20 rule provides a balanced blueprint for your paycheck:

50% for Needs: Housing, utilities, and groceries.

30% for Wants: Entertainment, travel, and dining out.

20% for Savings/Debt: This is your “wealth-building”

bucket.

If you are serious about early retirement, aim to ‘flip the script’ by capping wants at 20% and aggressive saving at 30% or more.

2. Pay Yourself First

Most people treat savings as a “leftover” activity. They pay the landlord, the grocer, and the streaming service, then save what remains. Usually, nothing remains. However, you must automate your investments. Move your 20% into your brokerage or savings account the second your salary arrives. Treat your future self like your most important bill.

3. Neutralise Lifestyle Creep

The “silent killer” of wealth is the tendency to increase spending as income rises. If you get a 10% raise and immediately upgrade your car, your net worth stays stagnant. The strategy should be to maintain your current standard of living for two years after every promotion. Divert your full salary hikes into your portfolio. This creates a massive gap between what you earn and what you spend.

II. The Math of Growth

4. The Rule of 72

Compounding is the “eighth wonder of the world”, but it can feel abstract. Use the Rule of 72 to make it concrete: Divide 72 by your expected annual return to see how quickly your money doubles. At an 8% return, your money doubles every 9 years. Understanding this timeline helps you stay patient during market fluctuations.

5. Eradicate High-Interest Debt

Debt is anti-wealth. If you have credit card debt at 20% interest, you are effectively fighting a headwind that no investment can beat. The Rule: Any debt over 7% is an emergency. Use the ‘Debt Avalanche’ method — pay off the highest interest rates first — to stop the bleeding before you focus on aggressive investing.

6. The 4% Withdrawal Rule

How do you know when you’re “done” working? The 4% rule is a benchmark suggesting that if you withdraw 4% of your total portfolio in your first year of retirement (adjusting for inflation later), your money has a high probability of lasting 30+ years. The Goal: Your “Freedom Number” is roughly 25x your annual expenses.

III. Protection and Strategy

7. The Emergency Fund (Opportunity Money)

A safety net of 3-6 months of expenses isn’t just for car repairs. It provides the psychological “staying power” required to keep your money invested when the market crashes. Without cash on hand, you may be forced to sell stocks at a loss just to pay rent.

8. Strategic Diversification

Concentration builds wealth; diversification preserves it. Ensure your eggs are in several baskets to survive different economic climates:

Equities: Low-cost index funds (VTSAX/VOO) for long-term growth.

Real Estate: For cash flow and tax advantages.

Bonds/Cash: For stability and liquidity.

9. The 24-Hour Cooling-Off Period

Impulse spending is the enemy of the “Big Win”. For any non-essential purchase over Rs 10,000, force yourself to wait 24 hours. Often, the dopamine hit of the “idea” of buying wears off, and your logical brain realises you don’t actually need the item.

10. Focus on the “Big Three”

Don’t stress over the Rs 350 latte if you’re spending 50% of your income on a house you can’t afford. Focus your energy on optimising:

Housing: Can you house-hack or move to a more affordable area?

Transportation: Do you need a luxury car, or will a reliable used vehicle suffice?

Food: How much is being lost to delivery apps and convenience? Master these three, and the small stuff won’t matter nearly as much.

/images/ppid_59c68470-image-177064754195770871.webp)

/images/ppid_a911dc6a-image-177069103696049438.webp)