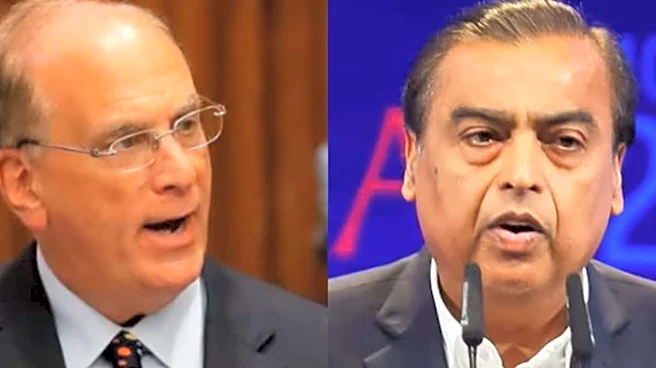

Larry Fink, Chairman and Chief Executive Officer of BlackRock, on Wednesday said long-term investors should look past short-term volatility and focus on what he described as the ‘era of India’, arguing that sustained participation in capital markets is key to wealth creation. Larry Fink was speaking in Mumbai at a Jio BlackRock fireside chat with Reliance Industries Chairman and Managing Director Mukesh Ambani.

Fink said excessive focus on near-term market movements, headlines and capital flows often distracts investors from the real opportunity — investing alongside the long-term growth of an economy. “As an investor, our job is not to react to every moment or every piece of noise,” Fink said. He emphasised that investing over long horizons

has historically delivered far better outcomes than holding money in bank deposits.

Fink said countries that succeed in expanding capital market participation tend to see broader wealth creation, as households invest alongside economic growth rather than remaining on the sidelines. He stressed the importance of encouraging more individuals to enter the market and remain invested over long periods to benefit from compounding returns.

“If you believe in the era of India, you need to think about investing over a long horizon and growing with the country,” he said, adding that long-term investing has consistently rewarded participants who stay invested through cycles.

The BlackRock chief said India’s growth story presents a compelling opportunity for investors willing to adopt a patient approach, arguing that the challenge lies not in identifying short-term market movements but in building confidence around long-term participation.

/images/ppid_a911dc6a-image-177082503054164938.webp)

/images/ppid_a911dc6a-image-17708270339242572.webp)

/images/ppid_a911dc6a-image-177082507024693587.webp)