An investigation into one of India’s most damaging “digital arrest” frauds has uncovered a network of educated men who allegedly used technical skills and social engineering to scam elderly victims, police

said.

So far, eight men have been arrested in connection with a ₹14.8-crore fraud involving an elderly couple in Delhi’s upscale Greater Kailash area. Investigators say the accused, drawn from varied professional and educational backgrounds, were linked through covert social media channels and operated under the direction of international handlers based in Cambodia and Nepal.

Delhi Police arrested the suspects across three states between January 15 and 21. Those taken into custody include an aspiring Chartered Accountant who ran an NGO, an IT diploma holder educated in New Zealand, a Varanasi-based priest, an MBA graduate, and a private tutor.

Divyang Patel, 30, a BCom graduate who had cleared the CA Intermediate examination, was the first to be arrested. Patel ran an organisation named Floresta Foundation along with a business advisory firm. Police say the NGO existed largely on paper and was allegedly used to receive and transfer illicit funds. He was arrested on January 15 in Gujarat along with Krutik Shitole, 26, who holds a diploma in information technology from New Zealand.

The following day, police arrested Arun Kumar Tiwari, 45, a BA graduate working as a private data-entry operator, from Uttar Pradesh. On January 19, Mahavir Sharma, 27, also a BCom graduate, was taken into custody. This was followed by the arrest of Pradyuman Tiwari, a priest who performs private pujas in Varanasi.

On January 21, police made three more arrests: Ankit Mishra, a former sales executive; Bhupender Kumar Mishra, 37, an MBA graduate employed in the private sector; and Aadesh Kumar Singh, 36, a private tutor. These arrests were made in Uttar Pradesh and Odisha.

Police say the eight men acted as facilitators, arranging and operating “mule” bank accounts to move stolen money on the instructions of an international syndicate. Seven mobile phones and several chequebooks were seized during the operation. Investigators believe more conspirators remain at large.

17 days under ‘digital arrest’

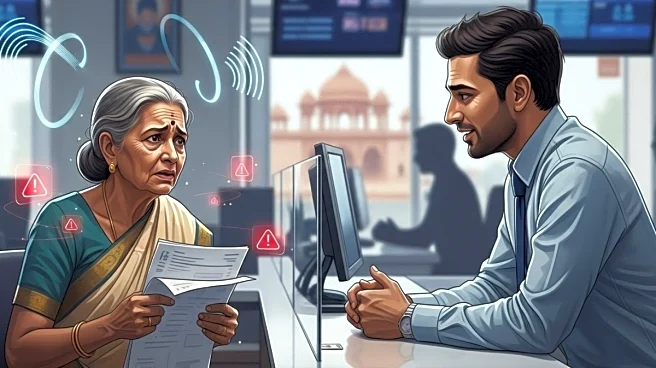

The victims, Om Taneja, 81, and his wife Indira, 77, were subjected to what police describe as one of the most disturbing “digital arrest” cases in recent memory.

The couple, who returned to India from the US in 2016, were allegedly kept under continuous video surveillance for more than 17 days. The ordeal began in December when Indira received a call claiming her phone number would be disconnected for making “obscene calls”.

She was then connected to a man dressed in a police uniform over video call, with banners reading “Colaba Police” visible in the background to enhance credibility. The fraudsters told her that her bank account was linked to a major money-laundering investigation.

When Indira explained that her husband was recovering from surgery and could not travel to Mumbai, the callers offered what they termed “digital verification at home”, portraying the matter as one of national security.

For over two weeks, the couple remained confined to their home, monitored through continuous video calls and threatened with severe consequences. They were coerced into transferring funds from fixed deposits into what the fraudsters claimed were “RBI-mandated accounts” for verification. In total, ₹14.8 crore was transferred through eight transactions.

The calls abruptly stopped on January 9. The couple later approached local police while waiting for a promised “refund” from the Reserve Bank of India — only to realise the money was gone.

How the case was cracked

The case was registered at the Special Cell’s Intelligence Fusion & Strategic Operations (IFSO) police station. Investigators initially focused on tracking the money trail, which led them to multiple mule account holders across states.

Police say the funds were rapidly broken into micro-transactions and routed through numerous secondary accounts to evade banking alerts. Much of the money is suspected to have been withdrawn in cash or converted into cryptocurrency. Investigators believe the funds may have passed through nearly 1,000 bank accounts, complicating recovery efforts.

A wider, troubling pattern

The Greater Kailash case reflects a broader national trend of elderly individuals being targeted through “digital arrest” scams.

In Mumbai, a 75-year-old retired civic official was defrauded of ₹16.5 lakh after fraudsters posing as National Investigation Agency officers claimed his name had surfaced in a terror probe. In another case, scammers extracted ₹4 crore from an 80-year-old man and routed an additional ₹1 crore through his account, potentially implicating him unknowingly.

One of the largest known losses involved 78-year-old former banker Naresh Malhotra, who was allegedly coerced into transferring over ₹23 crore to multiple accounts he believed belonged to the Reserve Bank of India after being accused of terror financing.

Supreme Court steps in

The Supreme Court of India has taken suo motu cognisance of the surge in such frauds, calling it a national crisis. The court has noted that nearly ₹3,000 crore has been siphoned off through “digital arrest” scams in recent years.

The bench expressed concern that even highly educated seniors are falling prey to such schemes, including those involving AI-generated deepfake videos, synthetic voices and staged “digital courtrooms”.

The court has also questioned whether Artificial Intelligence and Machine Learning tools are being adequately used to flag suspicious banking patterns.

Meanwhile, the Union Ministry of Home Affairs has set up a high-powered committee to improve coordination between police, banks and telecom operators.

Authorities have reiterated that no law enforcement agency conducts arrests over video calls or seeks money transfers for “verification”. Citizens receiving such calls are urged to immediately contact the National Cyber Crime Helpline at 1930.