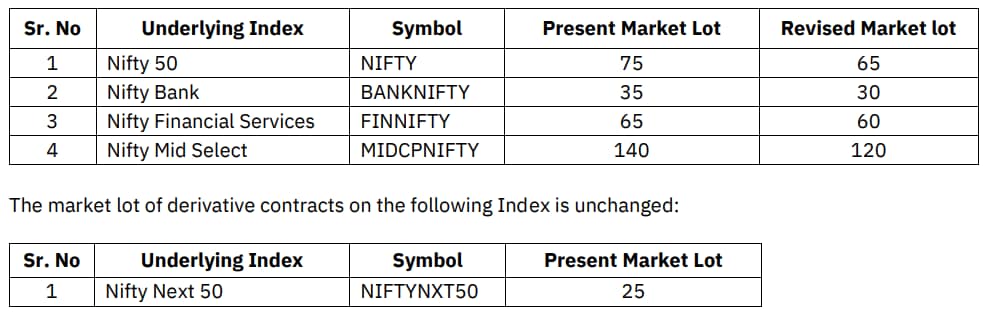

The National Stock Exchange (NSE) has announced the periodic revision of lot size for derivatives contracts. The lot size of the revised indices are: Nifty 50, Nifty Bank, Nifty Financial Services, and Nifty Mid Select.

Nifty Next 50 lot size has remained unchanged.

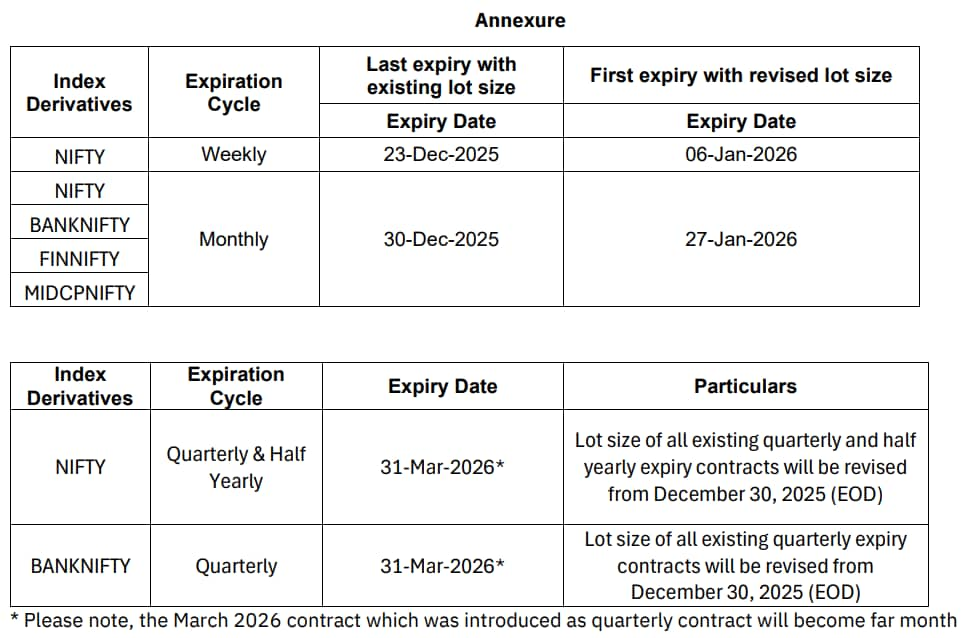

The new lot sizes will come into effect from October 28, 2025 (EOD). The existing lot size will be applicable for weekly and monthly contracts till December

30, 2025 expiry date. Lot size of existing quarterly and half yearly contracts will be revised on 30-Dec2025 EOD.

The market lot of derivative contracts on the following Indices shall be revised as follows:

Revised Lot Size Contract Expiry

Based on feedback from market participants and after a review by an expert working group and the secondary market advisory committee, Sebi had earlier revised the minimum contract value to Rs 15 lakh from the previous range of Rs 5–10 lakh. This adjustment will impact the Lot Size of newly introduced F&O contracts, which will now fall within the Rs 15–20 lakh range.

Sebi’s October 1, 2024, circular specifies that derivative contracts will have a minimum value of Rs 15 lakh at the time of introduction, with the Lot Size fixed to ensure that the contract value remains between Rs 15 lakh to Rs 20 lakh during reviews.

/images/ppid_a911dc6a-image-177105042575465447.webp)

/images/ppid_a911dc6a-image-177105033328862095.webp)

/images/ppid_a911dc6a-image-177105037137039801.webp)

/images/ppid_59c68470-image-177105003415990657.webp)

/images/ppid_59c68470-image-177105003432353455.webp)

/images/ppid_a911dc6a-image-177104902795770968.webp)