What is the story about?

The Indian mutual fund industry is poised for substantial growth over the next five years, with assets under management (AUM) expected to more than double, K V Kamath, Chairman of Jio Financial Services, said on Tuesday (February 4).

Speaking to CNBC-TV18, Kamath noted that banks will need to reinvent themselves to remain competitive and said the entry of Jio Financial Services in partnership with BlackRock comes at an opportune moment for the Indian market.

His statement comes as the AUM of the Indian mutual fund industry has surged over the past decade, rising from ₹12.75 lakh crore in December 2015 to ₹80.23 lakh crore as of December 31, 2025, a more than six-fold increase.

In the past five years alone, the industry’s AUM has nearly tripled, from ₹31.02 lakh crore in December 2020.

According to the Association of Mutual Funds in India (AMFI), the number of folios — or investor accounts — has also expanded significantly, reaching 26.13 crore as of December 31, 2025.

Retail participation remains strong, with over 20 crore folios under equity, hybrid, and solution-oriented schemes.

Open-ended equity funds have been a major contributor to AUM growth, with assets quadrupling over five years from ₹9 lakh crore in November 2020 to about ₹36 lakh crore in November 2025. Year-on-year, equity fund AUM rose more than 17%, driven by flexi-cap funds, which recorded the fastest growth of over 25% to ₹5.45 lakh crore.

Multi-cap and large-and-mid-cap funds also saw robust inflows, reflecting investor preference for diversified equity strategies amid changing market conditions.

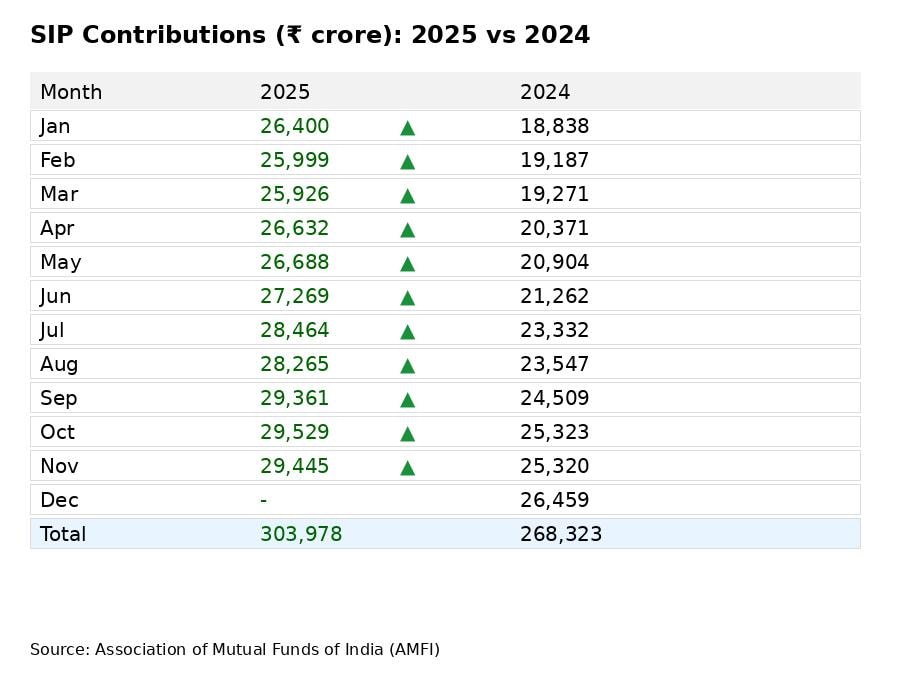

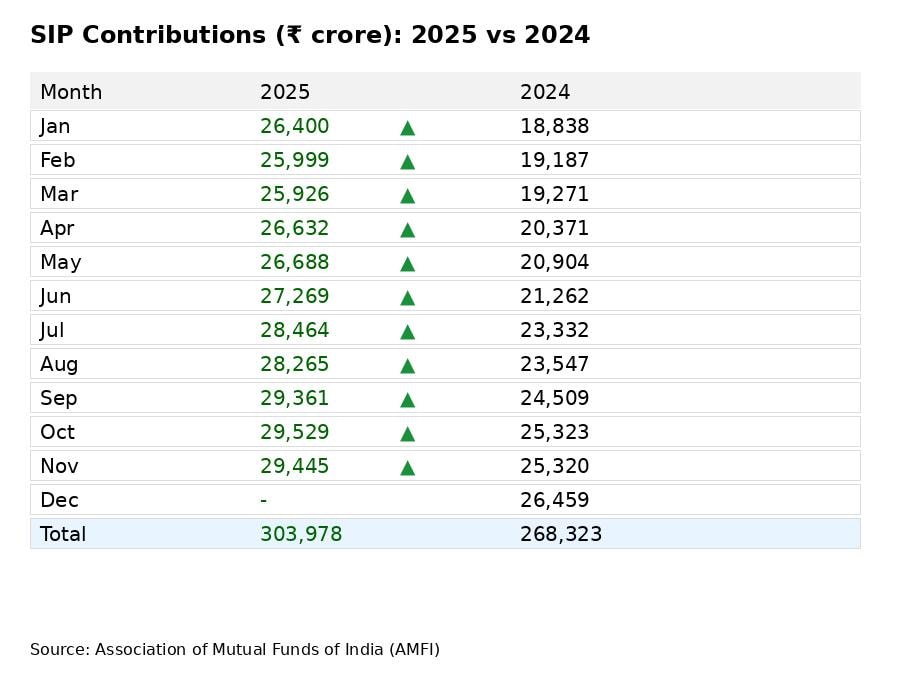

Industry analysts, including ICRA Analytics, project that the sector could surpass ₹300 lakh crore in AUM by 2035, driven by rising systematic investment plan (SIP) adoption and deeper penetration beyond top cities.

Jio Financial Services’ collaboration with BlackRock — the world’s largest asset manager, overseeing $14 trillion globally — leverages BlackRock’s proprietary portfolio management platform, Aladdin, to bring advanced risk management and investment capabilities to India.

Speaking to CNBC-TV18, Kamath noted that banks will need to reinvent themselves to remain competitive and said the entry of Jio Financial Services in partnership with BlackRock comes at an opportune moment for the Indian market.

His statement comes as the AUM of the Indian mutual fund industry has surged over the past decade, rising from ₹12.75 lakh crore in December 2015 to ₹80.23 lakh crore as of December 31, 2025, a more than six-fold increase.

In the past five years alone, the industry’s AUM has nearly tripled, from ₹31.02 lakh crore in December 2020.

According to the Association of Mutual Funds in India (AMFI), the number of folios — or investor accounts — has also expanded significantly, reaching 26.13 crore as of December 31, 2025.

Retail participation remains strong, with over 20 crore folios under equity, hybrid, and solution-oriented schemes.

Open-ended equity funds have been a major contributor to AUM growth, with assets quadrupling over five years from ₹9 lakh crore in November 2020 to about ₹36 lakh crore in November 2025. Year-on-year, equity fund AUM rose more than 17%, driven by flexi-cap funds, which recorded the fastest growth of over 25% to ₹5.45 lakh crore.

Multi-cap and large-and-mid-cap funds also saw robust inflows, reflecting investor preference for diversified equity strategies amid changing market conditions.

Industry analysts, including ICRA Analytics, project that the sector could surpass ₹300 lakh crore in AUM by 2035, driven by rising systematic investment plan (SIP) adoption and deeper penetration beyond top cities.

Jio Financial Services’ collaboration with BlackRock — the world’s largest asset manager, overseeing $14 trillion globally — leverages BlackRock’s proprietary portfolio management platform, Aladdin, to bring advanced risk management and investment capabilities to India.

/images/ppid_59c68470-image-177020503023858000.webp)

/images/ppid_59c68470-image-177020254757395001.webp)