The development comes just days after the IT major said that AI-related services have generated over $1.5 billion in revenue on an annualised basis, nearly 5% of the company's revenue, in Q3 of the current financial year.

Under the AMD partnership, both companies will co-develop industry-specific AI and generative AI solutions, combining TCS’s domain expertise and systems integration capabilities with AMD’s high-performance computing and AI hardware portfolio.

The companies said the collaboration will focus on modernising hybrid cloud and edge environments, deploying AI-powered digital workplace solutions and accelerating innovation across cloud-to-edge workloads. TCS will also upskill and certify its workforce on AMD’s latest hardware and software platforms, with both firms jointly investing in building a specialised talent pool.

Also Read: TCS Q3 Results: One-time labor code cost impacts net profit, margins meet estimates

Also in the plans are sector-specific GenAI frameworks for industries spanning life sciences, manufacturing and banking and financial services, covering use cases such as drug discovery, smart manufacturing and intelligent risk management.

AMD Chair and Chief Executive Lisa Su said demand for AI was accelerating and required “a new scale of high-performance computing and deep collaboration across the industry,” with the TCS partnership aimed at turning AI innovation into business growth.

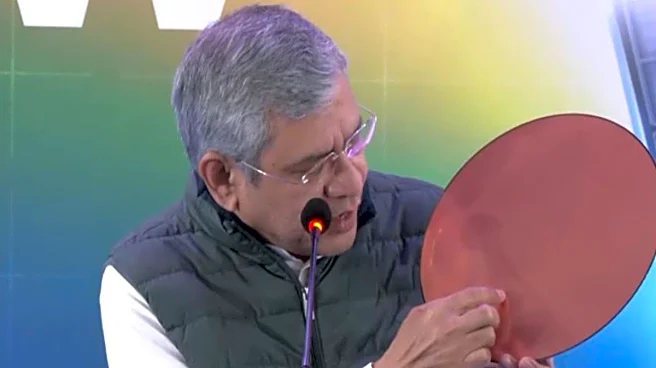

“Our collaboration with AMD is a significant step in scaling AI for the enterprise,” TCS Chief Executive K Krithivasan said, adding that the partnership would help clients move from experimentation to AI deployed at scale.

As part of the tie-up, TCS will integrate AMD Ryzen-powered client solutions for workplace transformation and use AMD EPYC CPUs, Instinct GPUs and AI accelerators to modernise hybrid cloud and high-performance computing environments. AMD’s embedded computing portfolio which includes adaptive system-on-chips and field programmable gate arrays, will support edge computing and industrial digitalisation.

Shares of TCS is trading at ₹3,214.30 apiece which is 1.64% higher than the day's opening on the NSE.

During an analyst call, TCS management also highlighted that AI is growing ahead of the overall revenue growth with a 16.3% sequential growth and 38.2% year-on-year growth in constant currency terms. TCS is also confident of new age services to contribute to nearly $11 billion in annualized revenue.

/images/ppid_59c68470-image-176837506181642586.webp)

/images/ppid_a911dc6a-image-177046452646494980.webp)

/images/ppid_59c68470-image-177046753706312192.webp)

/images/ppid_59c68470-image-177036256656188534.webp)

/images/ppid_59c68470-image-177027259697382602.webp)

/images/ppid_59c68470-image-177027256584255991.webp)

/images/ppid_a911dc6a-image-177028252417190660.webp)