What is the story about?

Bangladesh Nationalist Party wins parliamentary election, Tarique Rahman set to be next PM

The Bangladesh Nationalist Party (BNP) won the parliamentary election on Friday (February 13), a local TV station showed, as ballots were counted in a pivotal vote in Bangladesh.BNP had won 151 seats in the 300-member parliament, Ekattor TV showed, securing a simple majority. The Election Commission (EC) is yet to make a formal announcement.

Bangladesh election: Who is Tarique Rahman? From 17 years in exile to PM post

Tarique Rahman, 60, is set to be the next prime minister of Bangladesh. His party (BNP)— Bangladesh Nationalist Party (BNP)— has crossed the halfway mark in the crucial parliamentary election.

He is the son of BNP supremo and former Bangladesh PM Khaleda Zia. Rahman returned to Bangladesh in December 2025 after more than 17 years in self-imposed exile in London. He led the BNP into national elections — marking a dramatic political comeback.

How serious is AI risk to Indian IT services companies? Vishal Sikka explains

Artificial intelligence (AI) could begin to affect Indian IT services companies by changing how certain types of enterprise work are delivered, especially tasks that are repetitive and prescriptive in nature, according to Vishal Sikka, Founder and CEO of Vianai and former CEO of Infosys.“If you look at the application of generative AI to knowledge work, this disruption is real. It is here,” Sikka said, referring to the growing use of AI tools in areas such as code migration,

integration work and system connectivity.

These are tasks that typically form part of enterprise technology projects, including writing programmes to move data across systems or connecting different applications within an organisation. According to Sikka, teams using generative AI tools effectively have already reported significant gains in output. “I have seen examples of 20, 30x productivity gain.”

Someone who refrained from calling out the AI bubble for 3 years is changing their mind

Investors have been overwhelmed by the threat of artificial intelligence (AI) disrupting existing business models across industries, leading to a 2% fall in the S&P 500 over the last month. Interestingly, the sell-off has been steeper, at 4.79%, in the tech-heavy Nasdaq during the same period. The share of Nvidia and the

four major hyperscalers in AI—Amazon, Alphabet, Microsoft, and Meta—in the total market capitalisation of the S&P500, $60 trillion, has fallen from a record high of 27.4% in November 2025 to 24.7% at the end of January 2026, according to Jefferies. And, most of them have seen a sharp decline in February, too.

China bans below-cost car sales, here’s what it means for Tata Motors’ stock and its luxury cars

Tata Motors is likely to see some relief at its Jaguar Land Rover (JLR) unit after China moved to tighten rules on aggressive discounting. China’s market regulator has banned automakers from selling vehicles below total production cost, including administrative, financial and sales overheads.

A rare bet: Top stocks where promoters, DIIs and FPIs buy together

Institutional ownership typically reflects a shifting balance. When domestic institutions buy, foreign investors often sell, and when both turn net buyers, promoters are usually seen trimming their stakes. It is rare for all three—promoters, foreign institutional investors (FIIs), and domestic institutional investors (DIIs)—to be buyers at the same time.

Against this backdrop, here are the top companies where the trinity of promoters, FIIs and DIIs all increased their stake during the quarter.

India built the solar plants faster than the grid could handle

India’s clean energy transition now hinges less on announcing new targets and more on how institutions manage operational abundance. Curtailment at this scale is not merely lost green power;it is lost credibility. The choice before policymakers is not between grid security and renewable growth. It is between unmanaged adjustment and deliberate governance. Rajasthan has made that choice unavoidable.

How insurance is shifting from protection to prevention in 2026

While pricing remains relevant, it is no longer the sole factor influencing insurance decisions. Consumers are increasingly evaluating insurers based on ease of onboarding, responsiveness during claims, and the clarity of policy communication, notes SBI General Insurance MD & CEO Naveen Chandra Jha.

Gold, silver rebound after sharp fall: What investors should watch now

Gold and silver prices recovered on Friday (February 13) after sliding to one-week lows in the previous session, as bargain-hunting emerged following a sharp selloff triggered by strong US labour data. Spot gold rose 1% to $4,966.83 per ounce by 0127 GMT, after dropping more than 3% an ounce on Thursday (February 12) and briefly falling below the key $5,000 an ounce level.

Retirement planning: How to turn your corpus into monthly cash flow

Retirement planning is no longer just about saving money — it is about building a steady and predictable income for life after work. With rising inflation and longer life expectancy, creating a strong retirement corpus has become essential.

From mutual fund systematic withdrawal plans (SWPs) and dividend options to NPS, EPF, fixed deposits and bonds, investors today have multiple choices. The key question is: how should you combine them?

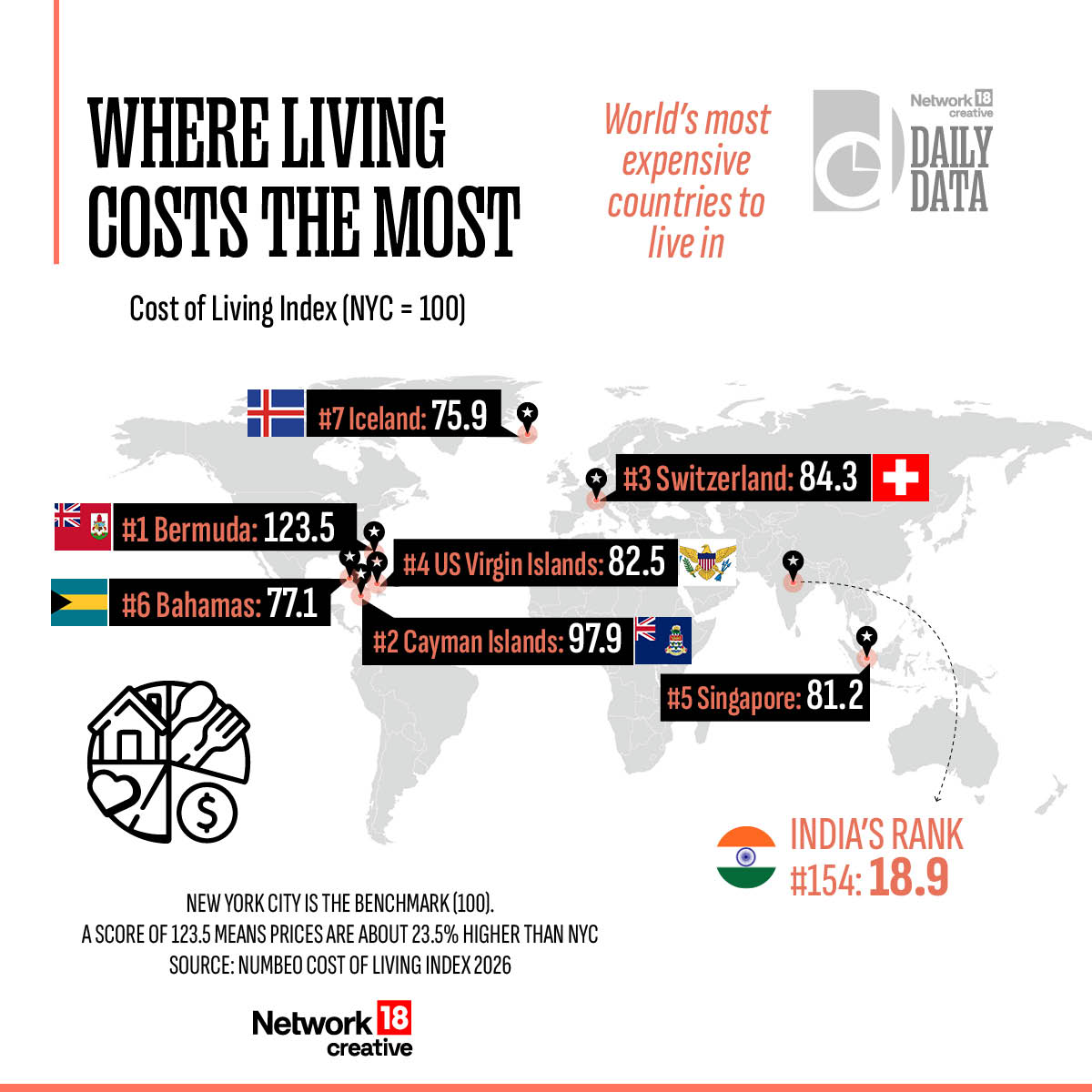

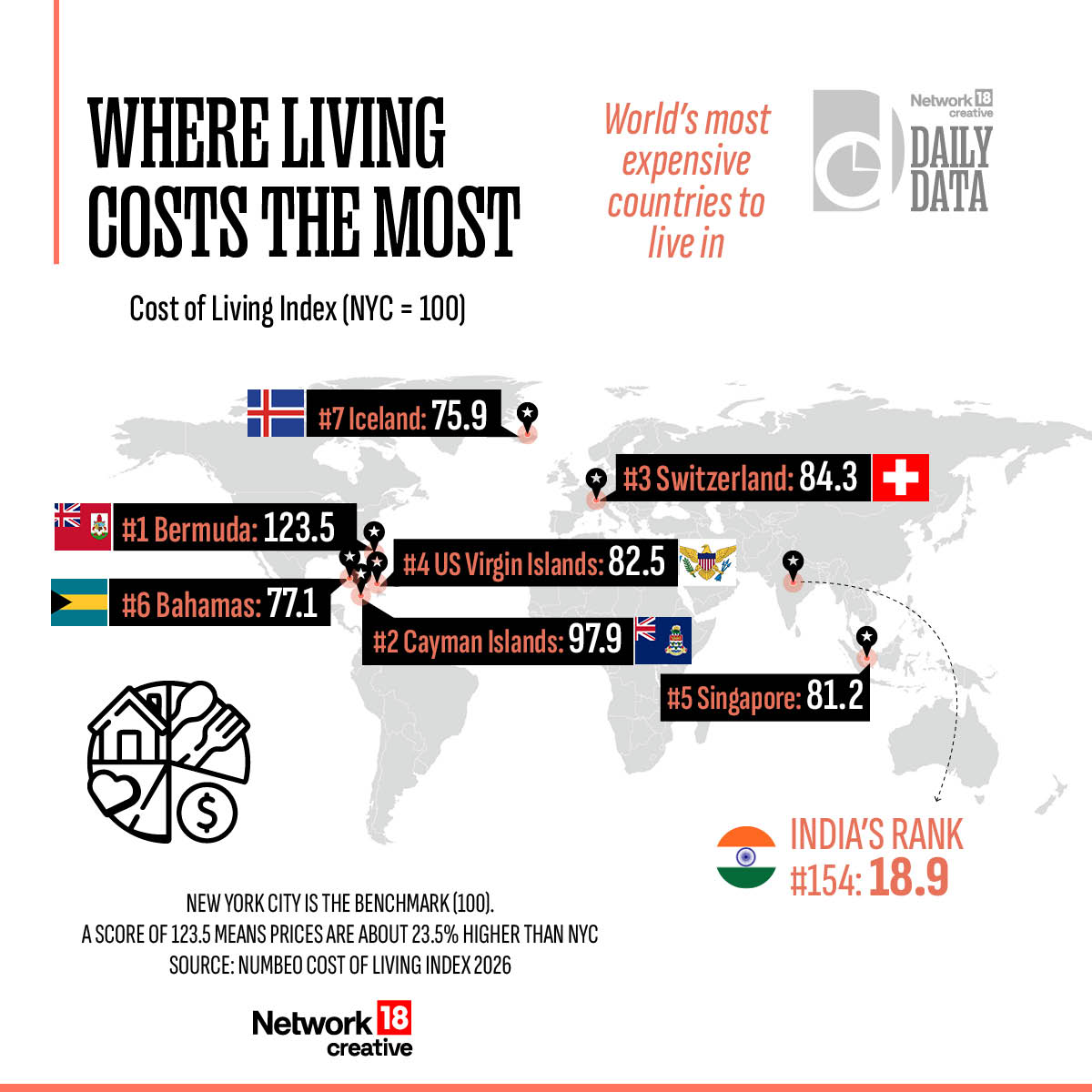

Daily Data | The world’s most expensive countries to live in, and where India stands

The Bangladesh Nationalist Party (BNP) won the parliamentary election on Friday (February 13), a local TV station showed, as ballots were counted in a pivotal vote in Bangladesh.BNP had won 151 seats in the 300-member parliament, Ekattor TV showed, securing a simple majority. The Election Commission (EC) is yet to make a formal announcement.

Bangladesh election: Who is Tarique Rahman? From 17 years in exile to PM post

Tarique Rahman, 60, is set to be the next prime minister of Bangladesh. His party (BNP)— Bangladesh Nationalist Party (BNP)— has crossed the halfway mark in the crucial parliamentary election.

He is the son of BNP supremo and former Bangladesh PM Khaleda Zia. Rahman returned to Bangladesh in December 2025 after more than 17 years in self-imposed exile in London. He led the BNP into national elections — marking a dramatic political comeback.

How serious is AI risk to Indian IT services companies? Vishal Sikka explains

Artificial intelligence (AI) could begin to affect Indian IT services companies by changing how certain types of enterprise work are delivered, especially tasks that are repetitive and prescriptive in nature, according to Vishal Sikka, Founder and CEO of Vianai and former CEO of Infosys.“If you look at the application of generative AI to knowledge work, this disruption is real. It is here,” Sikka said, referring to the growing use of AI tools in areas such as code migration,

These are tasks that typically form part of enterprise technology projects, including writing programmes to move data across systems or connecting different applications within an organisation. According to Sikka, teams using generative AI tools effectively have already reported significant gains in output. “I have seen examples of 20, 30x productivity gain.”

Someone who refrained from calling out the AI bubble for 3 years is changing their mind

Investors have been overwhelmed by the threat of artificial intelligence (AI) disrupting existing business models across industries, leading to a 2% fall in the S&P 500 over the last month. Interestingly, the sell-off has been steeper, at 4.79%, in the tech-heavy Nasdaq during the same period. The share of Nvidia and the

China bans below-cost car sales, here’s what it means for Tata Motors’ stock and its luxury cars

Tata Motors is likely to see some relief at its Jaguar Land Rover (JLR) unit after China moved to tighten rules on aggressive discounting. China’s market regulator has banned automakers from selling vehicles below total production cost, including administrative, financial and sales overheads.

A rare bet: Top stocks where promoters, DIIs and FPIs buy together

Institutional ownership typically reflects a shifting balance. When domestic institutions buy, foreign investors often sell, and when both turn net buyers, promoters are usually seen trimming their stakes. It is rare for all three—promoters, foreign institutional investors (FIIs), and domestic institutional investors (DIIs)—to be buyers at the same time.

Against this backdrop, here are the top companies where the trinity of promoters, FIIs and DIIs all increased their stake during the quarter.

India built the solar plants faster than the grid could handle

India’s clean energy transition now hinges less on announcing new targets and more on how institutions manage operational abundance. Curtailment at this scale is not merely lost green power;it is lost credibility. The choice before policymakers is not between grid security and renewable growth. It is between unmanaged adjustment and deliberate governance. Rajasthan has made that choice unavoidable.

How insurance is shifting from protection to prevention in 2026

While pricing remains relevant, it is no longer the sole factor influencing insurance decisions. Consumers are increasingly evaluating insurers based on ease of onboarding, responsiveness during claims, and the clarity of policy communication, notes SBI General Insurance MD & CEO Naveen Chandra Jha.

Gold, silver rebound after sharp fall: What investors should watch now

Gold and silver prices recovered on Friday (February 13) after sliding to one-week lows in the previous session, as bargain-hunting emerged following a sharp selloff triggered by strong US labour data. Spot gold rose 1% to $4,966.83 per ounce by 0127 GMT, after dropping more than 3% an ounce on Thursday (February 12) and briefly falling below the key $5,000 an ounce level.

Retirement planning: How to turn your corpus into monthly cash flow

Retirement planning is no longer just about saving money — it is about building a steady and predictable income for life after work. With rising inflation and longer life expectancy, creating a strong retirement corpus has become essential.

From mutual fund systematic withdrawal plans (SWPs) and dividend options to NPS, EPF, fixed deposits and bonds, investors today have multiple choices. The key question is: how should you combine them?

Daily Data | The world’s most expensive countries to live in, and where India stands

/images/ppid_59c68470-image-177096503953428764.webp)

/images/ppid_59c68470-image-177069008086153671.webp)

/images/ppid_59c68470-image-177069761118650612.webp)

/images/ppid_59c68470-image-177087756975063071.webp)

/images/ppid_59c68470-image-177095006121036330.webp)

/images/ppid_59c68470-image-177091507434334309.webp)

/images/ppid_59c68470-image-177095519003435839.webp)

/images/ppid_59c68470-image-177087262652841.webp)

/images/ppid_59c68470-image-177070253751678670.webp)

/images/ppid_59c68470-image-177070504854362320.webp)